Economic Net Worth Statement

The economic net worth statement starts from the net worth statement, but extends it to include human capital (present value of expected future labor income), while liabilities are extended to include consumption and bequest goals.

On this page, we discuss how wealth managers construct a net worth statement. Then we extend it to include human capital and liabilities related to consumption and bequest goals.

Net worth statement components

A private client’s assets on a net worth statement include:

- cash and deposit accounts

- brokerage/investment accounts

- Retirement accounts (e.g., defined contribution plan account or the present value of defined benefit pension)

- other employee benefits (e.g., stock options)

- stock/ownership of private companies

- life insurance policies with a cash value

- real estate

- other personal assets (e.g., cars, jewelry)

Liabilities on a net worth statement include:

- consumer debt and credit card balances

- mortgage loans

- other types of debt

- margin debt in brokerage accounts

Economic net worth statement example

The economic (holistic) balance sheet extends the traditional balance sheet assets to include human capital. Liabilities are extended to include consumption and bequest goals. This more complete economic view allows better planning of resource consumption to meet remaining lifetime goals.

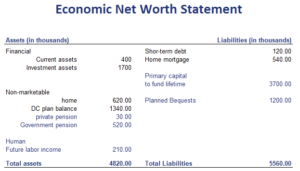

The following table is an illustration of what a holistic balance sheet may look like:

The items on the balance sheet in black refer to the components of a traditional new worth statement.

Net wealth can be positive or negative based on the adequacy of savings versus projected needs. If total liabilities exceeds total assets, it means net wealth is negative and the plans of the individual are unrealistic. For many people, total wealth (human capital + financial capital) will peak near retirement. Both will be drawn down in retirement.

Summary

The holistic balance sheet is used by wealth managers to help clients better plan for retirement.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Economic Net Worth Statement example