Acquisition Method

The acquisition method of accounting is used when a company acquires another company through a merger, an acquisition, or a consolidation. Whereas US GAAP distinguishes between these three ways in which a company can takeover another company, IFRS does not.

Acquisition method definition

What is the acquisition method? Historically, there have been two methods, (1) the purchase method and the (2) pooling-of-interests method. The pooling-of-interests method, however, no longer exists. The purchase method is now known as the acquisition approach. Before we discuss the acquisition approach, let’s quickly zoom into the pooling-of-interests method.

The pooling-of-interests method, or uniting-of-interests method consisted of combining the ownership interests of the two firms. The assets and liabilities were summed up. Under the pooling-of-interests method, the balance sheets were combined based on historical book values and the operating results were restated as if the companies had always been together. Fair values did not play a role. No goodwill was created.

Now let’s turn to the acquisition approach. The acquisition approach combines the balance sheet and the income statement and creates a minority interest on both the balance sheet and the income statement for the ownership in the firm that is not being acquired.

Acquisition method example

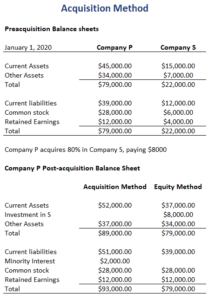

Let’s turn to an acquisition method of accounting example. The following table shows the balance sheets of two companies. We then aggregate the balance sheets using the acquisition method vs the equity method. In particular, we create a minority interest in stockholders’ equity for the part of the equity not acquired by the acquiring firm.

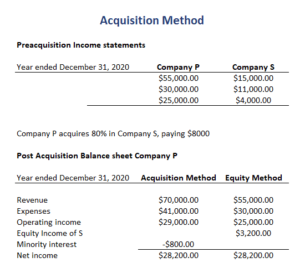

As for the income statements, the following table shows how to combine these. What is important here, is that we create a minority interest in the income statement for the portion of the company’s net income that is not owned by the acquiring company. This minority interest is subtracted in arriving at the consolidated net income.

Please note that the net income is the same under the acquisition approach and the equity method.

Acquisition goodwill

Finally, we also need to consider goodwill. On the page on acquisition goodwill, we discuss the necessary formulas to calculate acquisition goodwill.

Summary

We discussed the acquisition approach. This method should be used to aggregate the balance sheet and income statements when companies merge or are acquired.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Acquisition approach template