Effective number of stocks

The effective number of stocks is a stock concentration measure that investors calculate to analyze the level of concentration in a portfolio. While a portfolio may contain hundreds of securities, it may well be that the vast majority of the portfolio’s value is invested in only a small subset of securities.

On this page, we discuss the effective number of stocks formula. This measure is based on the Herfindahl-Hirschman index (HHI).

Effective number of stocks formula

The effective number of stocks formula is based on the Herfindahl-Hirschman index, so let’s first have a look at that formula

where n is the number of stocks in the portfolio and w is the weight of the stock. Thus, the HHI is the sum of the squared weights of the individual stocks in the portfolio. The HHI ranges from 1/n (equal-weighted portfolio) to 1 (a single stock portfolio). As HHI increases, concentration risk increases. For an implementation of the HHI in Excel, see the page on the Herfindahl-Hirschman index.

Now, the effective number of securities formula is simply the reciprocal of the HHI:

Example

Let’s consider a simple numerical example to illustrate the approach. Suppose we have a portfolio with 500 stocks. Suppose that portfolio is market-capitalization weighted and has a HHI of 0.01. Then the effective number of securities is 100. An equal-weighted portfolio of 500 stocks would have a HHI of 0.002 and therefore an effective number of securities of 1/0.002 = 500.

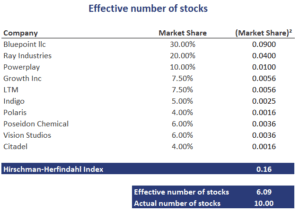

Now let’s consider another numerical example. The spreadsheet implementing the calculator can be downloaded at the bottom of the page.

Summary

We discussed stock concentration in portfolios and an easy way to calculate the effective number of securities based on the reciprocal of the HHI. It can be used to evaluate whether certain stocks may have a disproportionate effect on the performance of the overall portfolio.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Effective number of stocks calculator