Equity investing segmentation approaches

Equity investing segmentation approaches are used to classify equities by size and style, geography, and economic activity. By classifying securities into segments, we can get a better understanding of how equity investments integrate into the overall portfolio and enhance diversification benefits.

On this page, we discuss several segmentation approaches that equity investors frequently use. These classifications are size and style, geography, and economic activity.

Style and size segmentation

The first segmentation approach is to classify securities by size and style:

- Size, typically measured by market capitalization, can be categorized by large-cap, mid-cap, and small cap companies

- Style can be categorized by growth or value companies, or a mix of these two styles. A mix is typically referred to as a blend, whereas core is when no mix is applied

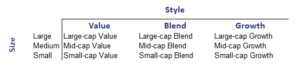

Often, investors will use a style box to rank or score portfolios among these metrics

The advantage of segmenting by style and size is that it can help portfolio managers better address client investment considerations in terms of risk and return characteristics. Another advantage is that it highlights the potential for greater diversification by spreading across these dimensions. Finally, it allows the construction of relevant benchmarks. The disadvantage is that the categories may not be stable over time.

Geography

The second segmentation approach is segmenting by geography. This approach categorizes international markets by stage of economic development such as developed markets, emerging markets, and frontier markets. An example of such a classification is the following:

- Developed markets: US, UK, Germany, Australia, and Japan

- Frontier markets: Argentina, Nigeria, and Vietnam

- Emerging markets: Brazil, Russia, South Africa, and China

The advantage of a geographical approach is that investors with a home bias can better understand how to diversify across international markets. The disadvantage is that investing internationally introduces currency risk. Also, because of globalization markets are strongly interconnected. This may create a false sense of diversification.

Economic activity

The third segmentation approach groups companies into sectors and industries. There are two approaches that can be used:

- Market-oriented approach: segments companies by markets served, how products are used by consumers, and how cash flows are generated

- Production-oriented approach: segments companies by products manufactured and inputs required.

The most commonly used approach is the Global Industry Classification Standard (GICS), which is a market-oriented approach.

Summary

We discussed equity segmentation approaches that investors can use to classify stocks. Each segmentation approach has its advantages and disadvantages.