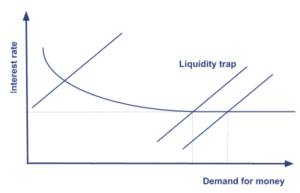

Liquidity trap

A liquidity trap is a situation in which in which a central bank’s efforts to stimulate spending fail because people hoard cash. A liquidity trap occurs when the central bank is forced to lower interest rates to zero. On this page, we discuss the concept of a liquidity trap, why it is bad for the economy and how we can try to escape it.

What is a liquidity trap?

The concept of the liquidity trap was proposed by the famous economist John Maynard Keynes in his book “The General Theory of Employment, Interest, and Money” in 1936. He argued that is is possible for central banks to end up in a situation where they are no longer able to stimulate the economy by lower interest rates. While lowering interest rates typically stimulates spending, because it makes borrowing cheaper and saving less attractive, it could be that demand for goods and services is so low that people don’t consume more.

In principle, it is possible to charge negative interest rates, that is, to pay people money to borrow and spend. Negative interest rates, however, may have undesirable side-effects. In particular, savers may withdraw their money when charged a negative interest rate. If banks lose their deposits, they may fail.

Why is a liquidity trap bad for the economy?

If lower interest rates does not stimulate the economy, there is a risk the economy ends up in a deflationary spiral where prices fall, causing people to delay spending, which causes prices to fall even more, and so on.

Liquidity trap solutions

Are there solutions to the liquidity trap? There are still other ways in which central banks can stimulate the economy. Central banks can provide direct support to companies, households, and local governments. More directly, governments can spend more money (fiscal policy). Because interest rates are kept low by the central bank, the government’s spending will also not create a “crowding out” effect.