Molodovsky effect

The Molodovsky effect refers to the empirical observation that price-earnings (P/E) ratios are high at the bottom of the economic cycle and unusually low at the bottom of the cycle. The effect was first described by Nicholas Molodovsky in 1953 in an article called “A Theory of Price Earnings Ratios”.

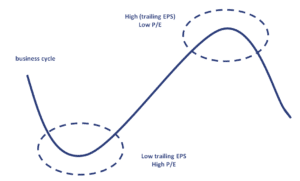

On this page, we provide a brief Molodovsky effect primer. In particular, we discuss the effect as well as a commonly used method to remove the effect. Finally, we present a graph that illustrates how the effect relates to the business cycle.

Molodovsky effect definition

The effect occurs because the earnings per share (EPS) are depressed during the bottom of the cycle. Thus, for a given stock price, the P/E will be unusually high. Similarly, P/Es will be unusually low at the top of the cycle simple because earnings are high relative to prices.

This observation goes against common belief that growth stocks are associated with high P/Es and value stocks with low P/Es. Earnings are, however, forward looking. This means that growth firms, for which high earnings are expected, will have a high denominator, thus lowering their P/E.

Application Molodovsky effect

The effect is something an analyst should be aware of when analysing a stock or an industry. The effect implies that it is important to always perform a cyclical stock evaluation.

Normalised earnings are an effective way to avoid a bias in the P/E ratio. In particular, by taking the average of the earnings over a business cycle, the earnings will not be impact by this effect. Normalising earnings avoids the P/E from becoming deflated or inflated simple because of the depressed or unusually high P/Es at the top or bottom of the business cycle.

The following chart provides a graphical representation of the effect.

Summary

We discussed the Molodovsky effect, a theory that argues that P/Es will be high at the bottom of the business cycle and low at the top of the business cycle.