Tax deferred versus tax exempt account

Asset location is one of the most important considerations for individuals who want to minimize the impact of taxes on performance. In many countries, individuals can choose accounts that allow funds to be deposited and invested in a tax-advantaged manner. Generally, no taxes are imposed on returns while the funds are in the account, allowing pre-tax compounding of returns.

On this page, we discuss two types of such accounts, tax-deferred accounts (TDA) and tax-exempt accounts (TEA). We discuss the relevant formulas and explain when to choose which type of account. A spreadsheet that implements the necessary formulas is available at the bottom of the page.

Tax-deferred accounts (TDA)

Pre-tax funds are deposited. The investor can take a tax deduction for the amount contributed, reducing taxable income and taxes due. Only when the funds are withdrawn will a tax be due on the full amount of withdrawals. The applicable tax rate will be the tax rate at time n (tn). We can calculate the future value after tax:

Tax-exempt accounts (TEA)

Because after-tax funds are deposited, no tax is due on the returns earned or on withdrawals. Therefore, we can simply calculate the after-tax future value simply as:

Choosing the account tax type

We would think that TEAs are superior to TDA, because there is no tax due on withdrawals. This, however, ignores the fact that the TEA uses after-tax funds, whereas the TDA uses pre-tax funds. When choosing between the two types of accounts, the choice crucially depends on our expectations about future tax rates.

To do a comparison, we use the following set of formulas:

Thus, if we expect

- t0 to be lower, then we pay taxes now and use the TEA

- tn to be lower, we pay taxes in the future and use the TDA

- tn to equal t0, then the two types of accounts will have the same ending value

Example

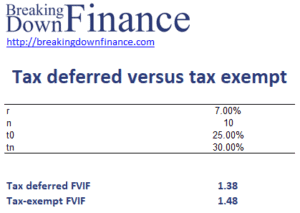

The following figure illustrates the above formulas using a numerical example. The spreadsheet can be downloaded at the bottom of the page.

Equal limits on contributions

Finally, we should mention a special case. If the contribution amounts are stated to be the same for TDAs and TEAs, then the TEA can be superior for maximizing future wealth if the current and future tax rates are equal. The limit on contributions is more generous for the TEA because the limit applies to the after tax value.

Summary

We discussed how an individual can choose between a TEA or TDA. The most important thing to consider is whether or not taxes are expected to be higher or lower in the future.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Tax deferred versus tax exempt account example