Fama-French 5 Factor Model

The Fama-French 5 factor model was proposed in 2015 by Eugene Fama and Kenneth French. The model improves the Fama and French 3 factor model (1993) by adding two additional factors. In particular, the original model of Fama and French proved inadequate to explain all of the variation in stock returns. Evidence since its publication emerged indicating that a company’s investing behaviour and profitability are related to the company’s stock performance. The two additional factors are based on the dividend discount model.

On this page, we discuss the Fama-French 5 factor model definition, discuss the Fama and French 5 factor model formula and application, and conclude with some criticism formulated by other researchers.

Fama-French 5 factor model definition

The model is specified as follows:

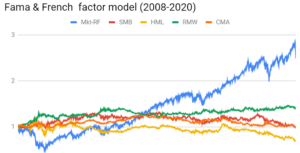

Where ri is the return on the security, rF is the risk-free rate, rM is the market return, SMB is the return spread between small capitalization stocks and large capitalization stocks, HML is the return spread between high book-to-market companies and low book-to-market companies, RMW is the return spread between profitable and unprofitable companies, and CMA is the return spread between companies that invest conservatively versus companies that invest aggressively.

Results reported by Fama and French (2015) indicates that the model is better able to explain stocks’ returns than the three factor model. Interestingly, Fama and French (2015) conclude that the companies that are small, profitable and value (i.e. have little growth prospects) will have the highest returns.

Fama-French 5 factor model application

Application of the model means that we estimate a stocks’ loading on the different factors (the betas) and then calculate the expected return of the stock using expected returns on the factors and the loadings.

Criticisms to model

Looking at the Fama-French 5 factor model, we notice that the model does not consider momentum and low volatility. Thus the model ignores or is unable to incorporate two anomalies that widely documented and that generate considerable returns. Another concern raised by other researchers is that the results do not appear to be robust. That is, the investment factor Fama and French (2015) is not that robust, meaning that it is not strongly priced.

Summary

Whether or not the new model of Fama and French will prove an improvement over the three-factor model is yet to be seen. In practice, most analysts still use the Fama-French 3 factor model when analysing a stock.