Theories of commodity futures returns

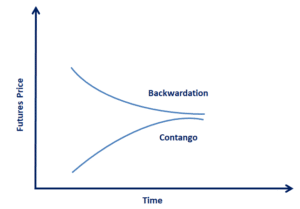

There are three main theories of commodity futures returns. All three theories try to explain the shape of the futures curve. We discuss all three theories and how well they can explain the observed shape of the futures curve.

Insurance theory

The insurance theory of futures returns was proposed by John Maynard Keynes. The theory argues that producers of commodities wish to reduce their price risk by selling futures contracts. Thus, producers want to purchase insurance. This selling drives down the futures price and should lead to a backwardation of the futures curve. This backwardation leads to a positive roll yield. This roll yield, received by the buyers of the futures contracts, compensates them for providing insurance.

According to the insurance theory, the yield curve should be predominantly in backwardation. This is referred as the fact that backwardation is normal. When this is in fact the case, the situation is called “normal backwardation”.

The problem with this theory is that market are in contango most of the time. Thus, it is not able to explain the shape of the futures curve.

Hedging pressure hypothesis

The hedging pressure hypothesis adds the behavior of commodity consumers. Consumers may also wish to hedge price risk. As a consequence, the yield curve will be in backwardation when the selling pressure of producers dominates and it will be in contango when the buying pressure of consumers dominates. This implies that, as markets are in contango most of the time, consumer hedging generally outweighs producers’ hedging.

Despite its intuitive appeal, the theory has a major shortcoming. Producers’ price risk is generally more concentrated than consumers’ price risk. That’s because consumers typically only spend a small amount on any given commodity. Thus, it is unlikely that consumer hedging will dominate.

Theory of Storage

The third theory we will discuss is the theory of storage. This theory argues that whether or not a market is in backwardation or contango depends on the relationship between the costs and benefits of holding a commodity.

When the benefits of holding a commodity outweigh the costs, the futures price will be lower than the spot price and the futures curve will be in backwardation. Similarly, when the costs outweigh the benefits, the yield curve will be in contango. That is because investors will prefer the futures contracts over holding the commodity physically, as the former does not incur storage costs.

While this theory is appealing, it is not possible to observe the benefits (convenience yield) and costs of holding a commodity directly. The theory of storage can be summarized using the following formula

Summary

We discussed the three main theories of commodity futures returns. While all three theories are intuitively appealing, it is generally not possible to test them empirically. The main reason is that we cannot observe the proposed drivers of the of the futures curve directly.