Duration-times-spread

Duration-times-spread is a measure that is calculated when analysing the macro-factors that can potentially affect a credit portfolio. It is part of the top-down approach that fund managers and credit analysts use. On this page, we discuss how the duration-time-spread (DTS) can be calculated and how it can be used to analyze the credit risk in a portfolio.

Duration-times-spread definition

To calculate the duration-times-spread, we need the portfolio average option-adjusted spread (OAS) and the spread duration (also based on a market value weighted average).

- A higher OAS spread implies that the portfolio is more exposed to credit risky assets.

- Spread duration indicates how much the portfolio will change in value if the spread changes

Duration-times-spread combines the two as follows

or

where S is the spread and SD is the spread duration. The advantage of this approach is that it gives us a more comprehensive indication of credit risk than either alone. Let’s consider an example of how to calculate DTS.

DTS example

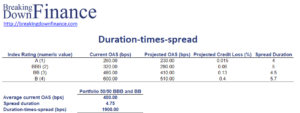

The following table implements DTS based on the OAS and spread duration. What is important here, is to keep in mind that we first need to calculate value-weighted measures of the OAS and spread duration.

The spreadsheet used can be downloaded at the bottom of the page.

Summary

We discussed the duration-times-spread, a useful measure to analyze the credit risk of a fixed income portfolio. This approach is used when performing top down analyses when executing fixed income (credit) strategies.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Duration-times-spread example