Changing portfolio duration with swaps

Changing portfolio duration of a fixed income portfolio can be done using interest rate swaps. This approach can easily be applied using an Excel spreadsheet as soon as we have the duration adjustment we wish to accomplish.

On this page, we discuss what type of interest rate swap to use. This depends on whether we want to increase or decrease duration. We also implement a simple numerical example that allows us to calculate the notional principal of the swap needed to adjust the portfolio duration. The spreadsheet used to implement this example is available for download at the bottom of this page.

Changing Portfolio Duration

What kind of interest rate swap do we need? This depends on whether we want to increase or decrease duration. In particular, we can:

- enter a receive fixed (versus paying floating) swap to increase portfolio duration

- enter a pay fixed (versus receive floating) swap to decrease portfolio duration

While any swap can be used to adjust the portfolio duration, the duration of the contract or swap will determine what specific point on the yield curve the derivative will subsequently respond to. In other words, there is also an effect on exposure along the yield curve. Thus, depending on the manager’s view of how the yield curve will change, the manager will choose a specific swap.

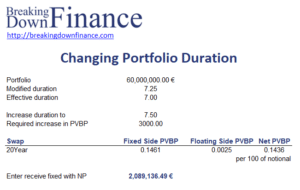

The notional principal of the swap to use is:

where PVBP of the swap is the difference between the fixed- and floating-side PVBPs.

Adjusting duration with swaps example

The following table implements a simple example that performs all the necessary calculations to adjust the duration of a bond portfolio:

The spreadsheet is available for download below.

Summary

We discussed how interest rate swaps can be used to alter the duration of a bond portfolio. If we want to increase duration, we use a receive fixed swap. If we want to reduce duration, we use a pay fixed interest rate swap.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Changing Portfolio Duration example