All-weather portfolio

An all-weather portfolio is a cross-asset portfolio based on the principle that an investment portfolio should provide stable returns, regardless of the economic environment. In other words, the portfolio is constructed in such a way that it does not make any predictions on what the future will hold. Instead, the portfolio attempts to generate stable real returns whatever the performance of the stock market.

The all-weather strategy was introduced by Ray Dalio and his hedge fund Bridgewater. On this page, we discuss the main principles on which the all-weather portfolio construction is based.

All weather strategy

The all-weather strategy is an asset allocation approach that uses risk parity. The securities in which it invests are mainly futures contracts. Fundamental CTAs, a kind of trend-following hedge funds, traditionally tend to rely on risk parity to construct portfolios and generate absolute returns.

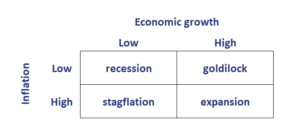

The first step in implementing an all weather strategy is to collect considerable amounts of historical data. This data is needed to understand how different asset classes behave under different market conditions. In particular, the all weather strategy distinguishes 4 different economic scenarios, based on a table that is very similar to an Eisenhower matrix:

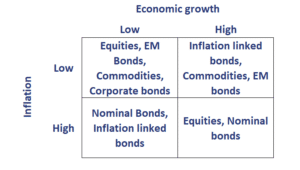

Thus, based on two different levels of economic activity (low and high growth) and two different levels of inflation (low inflation and high inflation), we can distinguish four scenarios. The aim is to identify how asset classes perform in the different economic environments. Suppose we end up with the following classification of which securities perform well in the different states of the economy:

Once we have classified the securities, we need to allocate assets in such a way that 25% of portfolio’s risk is allocated to each of the scenarios. This is because we do not know which scenario will actually take place in the future. Thus, the strategy does not try to predict the future state of the economy.

All Weather portfolio construction

To construct the all-weather portfolio, we need two ingredients. The first ingredient is risk-parity. Risk-parity means that we allocate across assets such that each assets contributes equally to overall portfolio risk. Second, once we have the risk-parity weights, the all-weather portfolio targets a certain level of target volatility, e.g. 15%. In practice, an all-weather portfolio will be implemented using futures contracts. The reason for this is that futures market are very liquid and resilient to financial shocks. Futures market have proven to be most resilient when liquidity in financial markets dries up. This ensures that the all-weather portfolio is less constrained by liquidity considerations.

Of course, retail investors do not have the capital to implement an all weather approach using futures. Instead, it is also possible to create a simple version of an all weather approach using ETFs. In particular, combining an equity index, corporate bond index, inflation linked government bond index, and a commodity index may suffice to construct a portfolio that is fairly robust to economic conditions.

Summary

We discussed the all weather asset allocation approach pioneered by Bridgewater Associates. An all-weather portfolio construction uses risk parity to allocate portfolio risk in such a way that the portfolio should perform well regardless of the market environment.