Forms of Performance-based Fees

Performance-based fees, which can be used both by hedge funds and mutual funds, are a form of risk sharing between the investor and the manager in order to align their interests. There are different forms of performance-based fees and they can be computed both on the basis of total or relative return. The fees (using a sharing percentage) could be based on total performance or performance in excess of a base.

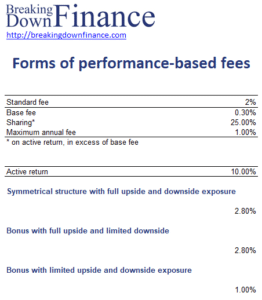

On this page, we discuss the three main forms of performance based fees. We also include a numerical example as well as a spreadsheet that illustrates how to perform the necessary calculations.

Types of performance based fees

There are three basic forms we will consider:

- symmetrical structure with full upside and downside exposures

The fee is calculated as:

This fee schedule provides the greatest alignment between investor and manager incentives but increased risk to the manager due to the full downside exposure.

- Bonus with full upside and limited downside

Fee is the greater of (1) base, (2) base + sharing of positive performance. This fee structure reduces the downside to the manager while retaining all the upside.

- Bonus with limited upside and downside exposures

Fee is the greater of (1) base, (2) base + sharing of positive performance (within limit).

This final performance fee limits the downside as well as the upside for the manager.

Performance-based fee consequences

Performance-based fee structures transform symmetrical gross active return distributions. The result is lower relative variance on the upside versus the downside. Therefore, by using a symmetrical risk measure such as standard deviation, there could be an underestimation of downside risk.

Performance-based fees benefit investors since they will pay relatively less in the case of underperformance. Such fees benefit managers as they may incentivize them to increase their efforts to benefit the investor’s portfolio and to increase their own compensation.

High-water and clawback provisions

Some investments have no limits on performance fees. In some cases, performance fees could be tempered to include high-water or clawback provisions. These provisions will offset prior period negative returns from current period positive returns.

Example

The following example implements the fee schedules we discussed above:

The spreadsheet is available for download at the bottom of this page.

Summary

We discussed different performance-based fee schedules that are commonly used by hedge funds. These fee structures are analogous to a manager having a long position in a call option on the portfolio active return.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Forms of performance-based fees example