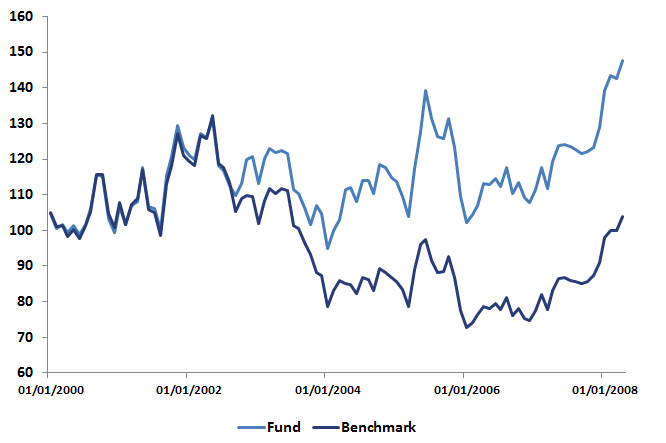

Upside downside capture

The upside downside capture is a measure used by investors to analyse the performance of fund managers. On this page, we discuss the concept of upside downside capture, provide the upside capture ratio, downside capture ratio and finally provide an Excel file that implements these concepts. To be able to calculate the statistics, the investor needs the returns of the fund he or she wants to analyse.

Upside capture ratio

First, we start with the upside capture ratio which equals the the percentage of market gains captured by a manager when stock markets are up over the period. So first, we need to determine all the periods in which the market was up. Once we’ve determined these periods, we select the returns for both the manager and the benchmark. The up capture ratio formula is then

![]()

where BM is the benchmark return, r is the return of the manager, and y is the number of up periods. The higher the up capture ratio, the better. The ratio should be greater than 100%. In that case, the manager did better than the market on days when the market was up.

Downside capture ratio

Similarly to the upside capture ratio, the downside capture measures the percentage of market losses endured by a manager when stock markets are down.

In the case of the downside capture ratio, the lower the better. If the ratio is less than 100%, it means that when the market went down the manager went down less. In principle, it is possible to see a negative downside capture ratio. In that case, it means that the manager has a negative beta on average, i.e. the manager went up when markets went down. This, of course, is very hard to achieve consistently.

Capture ratio

The capture ratio is based on a combination of the upside capture ratio and the downside capture ratio. In particular

Clearly, the higher the capture ratio the better. A capture ratio above 1 indicates that the manager captures more during up periods than he or she loses during down periods.

Interpretation

What are good values for the capture ratio? How much can we expect a manager to ‘capture’? The higher the capture ratio, the better. Still, investors should be realistic. In most cases the ratio will be close to one. Instead, it is better to compare different managers using the ratio, rather than analyzing the ratio on a stand-alone basis.

upside downside capture

Want to have an implementation in Excel? Download the Excel file: Upside downside capture calculator