Intermarket Curve Strategies

A bond portfolio manager can examine multiple markets and expected changes in each yield curve to select the optimal strategy. Such strategies may also be constrained to zero duration and zero net cash invested long/short approaches. These strategies are called intermarket curve strategies.

On this page, we discuss a number of basic inter-market strategies. We also illustrate these concepts using a simple duration and currency neutral intermarket curve trade example.

Basic inter-market curve strategies

First, we discuss different ways to set up inter-market strategies.

These strategies include:

- using a swap with payments made in the portfolio’s domestic currency. This will avoid currency risk. Note that the swap rate has embedded in it the hedge foreign currency risk from the forward currency market). For a swap based inter-market trade, we will:

-

- receive the rate at the end of a steeper segment of the yield curve. This will maximize the initial yield and expected roll down return

- pay floating based on the rate at a lower flatter segment of the yield curve

- using bond positions:

-

- buy a bond in one market at the end of a steeper segment of a yield curve to maximize initial yield and expected roll down return.

- short (borrow and pay the floating rate) in another market at a lower flatter segment of that yield curve

-

Duration and currency neutral strategy

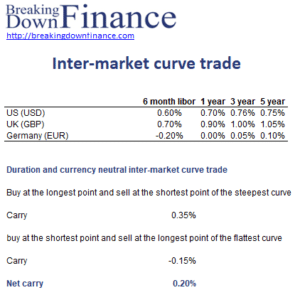

Next, let’s have a look at the following example. Based on the following yield curves, we will identify the appropriate duration and currency neutral curve strategy:

Note that this strategy has no net currency exposure because we are both long and short of the foreign currency. We also neutralize the positive duration exposure by buying at the shortest point and selling at the longest point of the flattest curve to minimize the carry lost.

Summary

We discussed a number of simple inter-market curve strategies that bond managers use.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Intermarket curve strategies example