Stratified Sampling

Stratified sampling for bond indexing, sometimes also called cell matching, is a method used to implement enhanced indexing. Fixed income markets are quite diverse, making full replication impractical. Stratified sampling is the most popular passive indexing replication method used by fixed income managers.

On this page, we discussed how cell matching works as well as how fixed income managers can add additional value within this framework.

Stratified sampling bond indexing

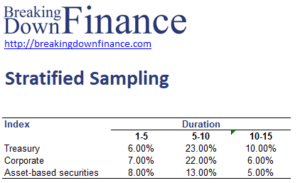

When using stratified sampling, the manager first needs to determine the most significant characteristics that need to be matched. For example, the manager could divide the index into multiple duration and sector groupings. The following table illustrates what the result could look like:

In each cell grid, the percentage of the bonds that fall within each cell are reported. To cell match, the manager will hold the same amount of bonds with these characteristics. At the same time, the manager need not use all of the same bonds as in the index to do so.

Advantages of cell matching

There’s several advantages to using cell matching. First, cell matching can incorporate environmental, social, and corporate governance (ESG) restrictions. The manager will try to meet these criteria while still matching the cell weights. A second advantage is that stratified sampling provides managers with considerable leeway to add value compared to an approach that uses pure indexing.

In particular:

- reduce fund expenses including transaction costs

- overweight undervalued and overweight overvalued securities, avoiding areas on the yield curve that expected to show spread widening and buying areas that may exhibit spread narrowing

- overweighting (or underweighting) callable bonds to earn a higher yield (increase convexity)

Summary

We discussed the basic principle behind cell matching as a strategy to replicate a passive fixed income index. The advantage of this approach is that the manager can try to add value while matching the main characteristics of the benchmark.