Minimum Variance Hedge Ratio (MVHR)

The minimum-variance hedge ratio (MVHR) is a mathematical approach that can be used to determine the hedge ratio when hedging a basket of currencies. It consists of running a regression of the past changes in the value of the portfolio to the past changes in value of the hedging instrument to minimize the value of the tracking error between these two variables.

On this page we discuss the approach and look at a numerical example that implements the approach. The spreadsheet used can be downloaded at the bottom of the page.

Minimum-variance hedge ratio definition

As we discussed in the introduction, the approach consists of regressing the returns of the portfolio against the returns of the hedging instrument with the aim of minimizing the tracking error between the two. The hedge ratio is the beta (slope coefficient) of that regression.

Note that the MVHR will jointly optimize over changes in the value of the foreign currency as well as the returns of the portfolio in foreign currency such that the volatility of the return in domestic currency is minimized.

Minimum-variance hedge ratio example

Let’s turn to a numerical example to illustrate how the minimum variance hedge ratio works. First we collect historical data on both the portfolio (say, a U.S. portfolio in EUR) and the foreign currency we wish to hedge (USD/EUR). Next, we run the regression of the portfolio’s returns (R_DC) in USD against the returns of USD/EUR

the beta is then the MVHR. In this case, the manager will short (beta * value fund in EUR).

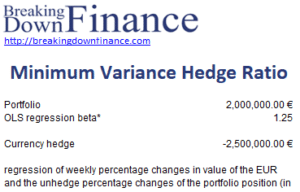

The following table implements the approach using a numerical example. Imagine we regress the weekly changes of the EUR (against the USD) and the unhedged percentage changes in value of the portfolio position (in USD) and wish to hedge the FX risk. We get the following result:

Summary

We discussed the min var hedge ratio. It is an example of a cross hedge approach or proxy hedge approach. It means that the instrument is not perfectly correlated with the exposure being hedged.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Minimum Variance Hedge Ratio example