Acquisition Goodwill

Under the acquisition method, acquisition goodwill is the remainder of the purchase price that cannot be allocated to identifiable assets and liabilities (based on fair value). Acquisition goodwill is said to be an unidentifiable asset that cannot be separated from the business.

On this page, we look at the acquisition goodwill definition, the acquisition goodwill formula, and discuss the goodwill calculation using an Excel example.

Acquisition goodwill definition

There are two kinds of goodwill we need to consider. Under US GAAP, we have full goodwill. Under IFRS, both partial goodwill and full goodwill can be used.

Let’s start with full goodwill. In this case, goodwill is defined by the amount by which the fair value of the acquired firm is greater than the fair value of the firm’s identifiable net assets. Partial goodwill, which can also be used under IFRS, is the excess of the purchase price over the fair value of the acquiring company’s proportion of the acquired company’s identifiable net assets.

The full goodwill formula equals

The partial goodwill formula equals

or

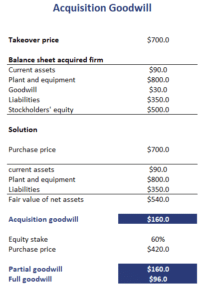

Goodwill calculation example

Let’s look at an full and partial goodwill example using Excel. The following table implements the above formulas. In particular, we calculate both the full goodwill and the partial goodwill. The spreadsheet used can be downloaded at the bottom of the page.

We note that the full goodwill method leads to higher total assets and higher total equity. Thus, ROE and ROA will be lower under the full goodwill method.

Finally, it is important to know that goodwill is not amortized. Instead it is tested for impairment at least annually. To do this, one has to calculate the implied fair value of the goodwill and compare it to the goodwill on the books.

Summary

We discussed the full goodwill and partial goodwill method. Both can easily be calculated using an Excel spreadsheet.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Acquisition Goodwill Calculator