Pure-play method

The pure-play method is a method used to determine the required rate of return of a project. In particular, the pure-play method is used to calculate the project beta. On this page, we discuss how to apply the pure-play method. At the bottom of the page, we include an Excel spreadsheet example that implements the pure-play method.

Pure-play method explained

Why do we use the pure-play method rather than the capital asset pricing model to determine the required rate of return? The reason is that a firm’s average risk is not the same across the different projects that a firm undertakes. This means that if a project is more risky than average, we should use a higher cost of capital, and vice versa. Since specific projects are typically not represented by a publicly traded security, we do not observe the project beta directly.

Instead, we can use the equity beta of a publicly traded firm that is engaged in an activity very similar to the project that we are considering. In particular, we look for a company that is ‘purely‘ engaged in the type project for which we want to estimate the cost of capital. Of course, the beta of that company not only depends on the activity. It also depends on the capital structure of the company. We therefore need to adjust it. In particular, we will calculate the unlevered beta and then relever it to obtain the levered beta.

Pure-play method formula

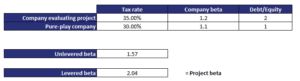

As we mentioned above, we need to adjust the pure-play beta from the pure beta company for the company’s use of leverage (unlever it) and then adjust it back (re-lever) it based on the financial leverage used by the company that is considering the project.

First we calculate the unlevered beta or asset beta using the following formula:

where D/E is het comparable company’s debt-to-equity ratio and t is the marginal tax rate of the comparable company. Next, we re-lever the beta again. This time we use the D/E and tax rate t of the company that is evaluating the project.

Disadvantages pure-play method

There are two important disadvantages to using the pure-play method. First, we need to use historical data to estimate the betas. These betas are backward-looking and depend on the amount and frequency of the data used. Second, the beta depends on the market index that is used to represent the market return.

Pure-play method example

Let’s consider a numerical example. Suppose we have a company who is evaluating a project. The company also identified a pure-play company that only engages in the type of activity that the company is considering. The project beta can then be calculated as follows (see figure). The spreadsheet with the calculations is available at the bottom of the page.

Summary

In practice, investors will use a list of pure play companies to choose from to calculate the project beta use the method described above. Such lists of pure play companies are sometimes provided by investment research companies.

Pure play method calculator

Download the Excel spreadsheet pure-play method example: pure-play-method-calculator-excel