Buyback Yield

The net common buyback yield is a measure of the amount of a company’s stock that is repurchased by the company, relative to its market capitalization. The buyback ratio can be be defined using the following formula:

Buyback Yield = (Stock Buybacks – New Issuances) / Market Capitalization

In this case Stock Buybacks equals the total value of the company’s stock that was repurchased during a given period (such as a year), New Issuances is the total value of new shares that were issued by the company during the same period, and Market Capitalization is the market value of the company’s outstanding shares.

Buybacks are one way in which companies reward investors. By purchasing its own stock, a company effectively returns capital to the shareholders.

To see this, imagine the free float of a company’s stock consists of 100 shares worth 1 dollar and the earnings of the stock equal 5 dollars. Now imagine the company buys back 10 stocks. The investors who owned the stock receive cash. In addition, the capital of the company declined from 100 dollars to 90 dollars. It means that the same amount of earnings will now be distributed across less shares. The earnings yield goes from 5% to 5.55%

Buyback yield formula

In practice, we use a slightly different method to calculate the buyback yield. In particular, we record the number of shares outstanding and calculate the annual change in the number of shares outstanding.

The advantage of this approach is that it can easily be applied once we have the data, without having to collect companies’ announcements on stock buybacks.

The formula equals:

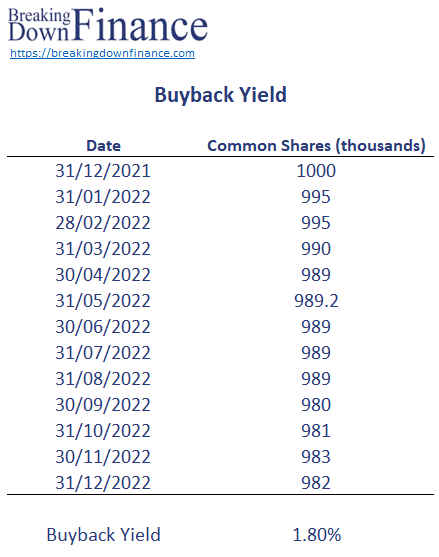

The following example in Excel illustrates the approach. The spreadsheet can be downloaded at the bottom of the page.

Summary

The net common buyback yield is often used as a measure of companies’ commitment to returning value to shareholders through share repurchases. Companies with a high net common buyback yield are often seen by analysts as being more shareholder-friendly, as they are actively reducing the number of outstanding shares and potentially increasing the value of each remaining share.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Buyback Yield Excel