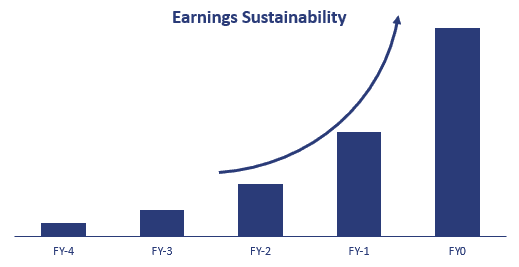

Earnings Sustainability

Earnings sustainability refers to a company’s ability to consistently generate profits over time. Whether or not companies’ earnings are sustainable is an important consideration for investors. Companies that have a history of stable and growing earnings are generally seen as more financially stable and potentially more valuable than a company with volatile or declining earnings.

There are several factors that can impact a company’s earnings sustainability. They include the company’s business model, the strength of its competitive position, and the quality of its management. On this page, we discuss how investors can analyze the company’s earnings sustainability based on earnings and based on an analysis of the company’s competitive environment.

Assessing earnings sustainability

There are two ways to assess a company’s earnings sustainability. The first approach we already alluded to in the previous paragraph. In particular, we can perform a qualitative analysis of the company’s competitive environment.

One useful framework in this context is Porter’s Five Forces. This model, developed by Michael Porter, allows us to identify and analyze the competitive forces that shape an industry and help us to determine the profitability and thus the sustainability of those profits or earnings.

In the context of earnings sustainability, the Five Forces can be used to analyze the competitive forces that a company is facing. In particular, we can determine how the forces might impact the company’s ability to sustain its earnings over time.

Let’s consider an example. If a company is facing strong competition from new entrants or substitutes, it may be forced to lower its prices or invest in R&D to develop new products in order to remain competitive. If at the same time the company has strong bargaining power with its suppliers, it may be able to negotiate lower prices and improve its profitability.

A second approach we can use is a more quantitative approach to analyzing earnings sustainability. In particular, we can analyze the earnings quality using the Sloan ratio, which determines whether or not a company is relying extensively on accruals to report high earnings. Alternatively, we can perform financial statement analysis to yield a summary statistic that tells us about the persistence of earnings. This can be done by identifying transitory items in earnings and omitting them. A popular approach in this regard is the work of Stephen Penman and Xiao-Jun Zhang in their 2005 paper “Modeling Sustainable Earnings and P/E Ratios Using Financial Statement Information”.

Summary

We discussed two approaches that analysts can use to analyze the earnings quality. Such an analysis is important since investors should not overpay for earnings that are transitory and that will not persist.