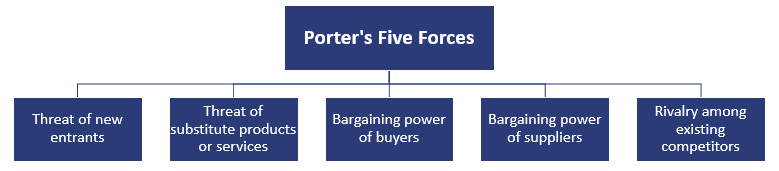

Porter’s Five Forces

Porter’s Five Forces is a very popular model in the field of strategy management. The model at the end of the 1970s by Michael E. Porter, a professor at Harvard Business School. Michael Porter first described the model in his book “How Competitive Forces Shape Strategy” which was published in 1979.

In the book, Porter argues that the intensity of competition and thus the sustainability companies’ earnings in an industry is determined by five forces: the threat of new entrants, the threat of substitute products or services, the bargaining power of buyers, the bargaining power of suppliers, and the competition among competitors.

On this page, we briefly summarize Porter’s Five Forces and then turn to a very simple application of the model.

Porter’s Five Forces Explained

The five so-called forces are:

- Threat of new entrants: the first force looks at how easy it is for a company to enter the industry under consideration. If it is easy for new companies to enter, then existing companies may face more competition. Profits can quickly be under pressure. If it is difficult to enter an industry (e.g. because time or many investments are needed to get started) then existing companies will enjoy higher profits

- Threat of substitute products or services: the second force looks at how easy it is for customers to switch to a substitute good or service. If there are many good substitutes available, then existing companies will have a harder time to raise prices and thus will potentially have lower profits.

- Bargaining power of buyers: the third force looks at how much power customers have to negotiate prices and terms with companies. If customers have a lot of power (e.g. they can easily switch to the competition), then companies will have to lower prices or offer better terms in order to win their business

- Bargaining power of suppliers: the fourth force looks at how much power suppliers have to negotiate prices and terms with companies. If suppliers have a lot of bargaining power, then companies may have to pay higher prices or accept worse terms.

- Rivalry among existing competitors: the final force looks at how intense the competition is among corporations in the industry that is being analyzed. If competition is intense, then companies may have to work harder to win and hold customers.

Now that we have discussed Porter’s Five Forces, we can apply them to a real industry.

Porter’s Five Forces Example

We can apply Porter’s Five Forces framework to the airline industry.

- First, the threat of new entrants is low, as it requires a significant amount of capital to start an airline.

- Second, while there are some substitute services to get from A to B (trains and buses), they are not always as convenient or practical as flights to travel long distances.

- Third, customers have some bargaining power, as there are many airline companies to choose from and prices and level of comfort can vary significantly.

- Fourth, suppliers, such as aircraft manufacturers, have some bargaining power, as airlines have to continuously maintain their aircraft to ensure they are safe

- Finally, rivalry among existing competitors is intense, as there are low budget airlines that compete for customers that are price sensitive.

Summary

We discussed Porter’s Five Forces, a very popular model used in business schools to analyze the competitive environment of an industry. Porter’s five forces can also be used to judge the sustainability of companies’ earnings.