Fixed-rate Perpetual Preferred Stock

A firm that has no additional opportunities to earn returns in excess of the required rate of return should distribute all of its earnings to shareholders in the form of dividends. If this is the case, then we can easily determine the fair value of the stocks using a simple formula that is used to value a noncallable fixed-rate perpetual preferred stock.

On this page, we discuss how to calculate the value of a fixed-rate perpetual preferred share. We also discuss a simple numerical example that illustrates the approach. The Excel spreadsheet used is available for download at the bottom of the page.

Fixed-rate perpetual preferred shares formula

If the firm has no additional opportunities to earn returns in excess of the required rate of return, then the growth rate is zero, and the current value of the firm will be equal to the current dividend divided by the required rate of return. This coincides with the approach used to determine the fixed rate perpetual preferred share price:

where Dp is the preferred dividend (which is assumed not to grow) and rp is the cost of preferred equity.

Fixed-rate perpetual preferred stock value example

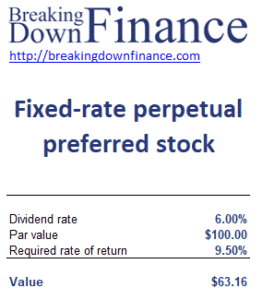

Next, let’s consider a simple numerical example of a fixed-rate perpetual preferred stock outstanding with a dividend of 6% (with a par of $100). If the investor’s required rate of return for holding these shares is 9.5%, then we can calculate the value as follows:

The spreadsheet used to implement the formula is available for download at the bottom of this page.

Summary

We discussed how to calculate the value of a noncallable fixed-rate perpetual preferred share.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Fixed-rate perpetual preferred share example