Guideline Public Company Method

The Guideline Public Company Method (GPCM) is a method used to value private companies. The GPCM method uses prices multiples from data on comparable public companies. The multiples are then adjusted to account for differences between the private firm we wish to value and the comparable firms. When applying the approach, the critical step is to ensure that the companies we use as comparables are in fact comparable.

Guideline Public Company Method formula

The GPCM collects data on comparable firms, such as the MVIC to EBITDA multiple and then adjusts these multiples for differences between the comparable companies and the subject company. Thus, there is no specific formula associated with the Guideline Public Company Method. Instead, very often, a formula we do need to use when applying the GPCM is the ratio of the market capitalizations. Many of the multiples we consider under the GPCM need to be rescaled to adjust for the size of the companies. The example we discuss below illustrates how to apply an inflation/deflation factor to adjust the ratios of comparable companies.

Guideline Public Company Method steps

The steps involved in applying the GPCM are as follows. First, we need to collect a list of comparable companies. How many companies is enough? That’s hard to say. The more comparable the companies are, the fewer companies you need. If the companies are somewhat different from the subject company, we may need to collect data on more companies to get a more accurate estimate.

Once we have data on the other companies, the next step is to adjust the ratios of these companies such that they are comparable to the subject company. Finally, we take the average of the adjusted ratios across the companies and compare these to the subject company.

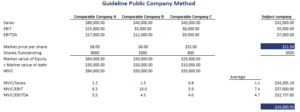

Guideline public company example

Let’s consider a very basic example where collect data on a few companies, adjust them, and then compare them to the subject company.

Summary

We discussed the GPCM. This method uses price multiples of comparable public companies to value a private company.

GPCM calculator

Want to have an implementation in Excel? Download the Excel file: Guideline Public Company calculator