Return on Net Operating Assets (RNOA)

Return on net operating assets (RNOA), sometimes also called the enterprise rate-of-return, is a financial ratio that measures the profitability of a company’s operations. It is calculated by dividing the company’s net operating profit by its net operating assets.

- Net operating profit is a measure of a company’s profitability that excludes taxes and other non-operating expenses. It is calculated by subtracting the company’s operating expenses from its operating income.

- Net operating assets are the assets that a company uses to generate revenue, such as property, plant, and equipment, inventories, and accounts receivable.

RNOA is often used to assess the efficiency of a company’s operations and to compare the profitability of different companies within the same industry. A higher RNOA indicates that a company is generating more profit from its operations relative to the assets it has invested in those operations.

On this page, we discuss the RNOA formula, implement a numerical example in Excel and make the spreadsheet available for download at the bottom of the page.

RNOA formula

The formula for calculating return on net operating assets (RNOA) is:

RNOA = (Net Operating Profit / Net Operating Assets) * 100

Where:

- Net operating profit is calculated as: Operating Income – Operating Expenses

- Net operating assets are the assets that a company uses to generate revenue, such as property, plant, and equipment, inventories, and accounts receivable.

To calculate RNOA, we will need to gather the following information:

- Operating income: This is the company’s income from its main operations, before subtracting taxes and other non-operating expenses. It can be found on the company’s income statement.

- Operating expenses: These are the expenses incurred in the course of the company’s main operations, such as cost of goods sold, selling, general, and administrative expenses, and research and development expenses. They can also be found on the company’s income statement.

- Net operating assets: These are the assets that a company uses to generate revenue, such as property, plant, and equipment, inventories, and accounts receivable. They can be found on the company’s balance sheet.

RNOA example

Once we have this information, we can plug it into the formula to calculate the company’s RNOA. For example, if a company has an operating income of $1,000,000, operating expenses of $500,000, and net operating assets of $2,000,000, its RNOA would be calculated as follows:

RNOA = (1,000,000 – 500,000) / 2,000,000 * 100 = 25%

This would indicate that the company is generating a 25% return on its net operating assets.

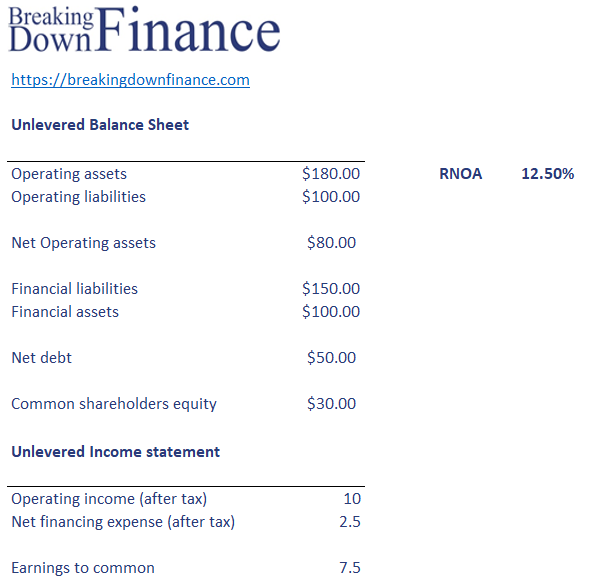

Let’s consider a slightly more complex example in the following table:

The spreadsheet can be downloaded at the bottom of the page.

Summary

We discussed the enterprise rate of return or return on net operating assets. This is a valuation measure that is very popular among value investors. One good reference on the measure is the work of Stephen Penman.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: RNOA