Acceptable Rebalancing After Tax Range

Portfolio rebalancing is often required to maintain the strategic asset allocation. Taxable investors will realize taxable gains when they rebalance. Thus, it is important to balance maintaining the strategic asset allocation with the desire to avoid taxable gains through frequent rebalancing. On this page, we discuss the acceptable rebalancing after tax range formula and implement the approach using an Excel spreadsheet.

The acceptable rebalancing post-tax range template can be downloaded at the bottom of the page. The acceptable rebalancing after-tax range is related to the calculation of the after-tax standard deviation.

Allowable deviation from target formula

To determine the acceptable rebalancing range we first need to find the allowable deviation from target

where t is the tax rate. It is important to understand that taxes increase the allowable deviation from the target allocation weights (compared to the pre-tax deviation).

After-tax deviation from target example

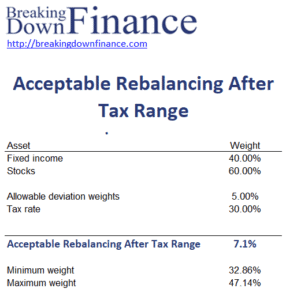

Let’s consider a numerical example of the after-tax deviation from target allocation weight. Suppose we have a tax-exempt investor which a strategic asset allocation that is 40% fixed income, which an acceptable deviation of +/- 5%. Now suppose fixed income returns are subject to a 30% tax rate. What would be the equivalent after-tax rebalancing range?

Applying the formula, we get

Thus, the acceptable range is 32.86-47.14%. An Excel template is available at the bottom of the page. The following table illustrates the necessary steps:

Summary

We discussed how to calculate appropriate rebalancing ranges in the case of taxes. This range is based on the optimal range in the absence of taxes. This approach is strongly related to two popular strategies that are used to reduce the impact of taxation, i.e. tax loss harvesting and strategic asset allocation in asset classes that are more tax advantageous.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Rebalancing After Tax Range Calculator