Composite Returns Calculation Methods

When firms are required to report performance by composite, where a composite is a group of accounts with similar objectives, then firms can choose among three calculation approaches. Global Investment Performance Standards (GIPS) requires firms to use one of the composite returns calculation methods when reporting performance to clients and prospective clients.

On this page, we discuss the three methods that firms can use to calculate composite returns. An Excel spreadsheet that implements each of the approaches is available at the bottom of this page.

Composite return calculations

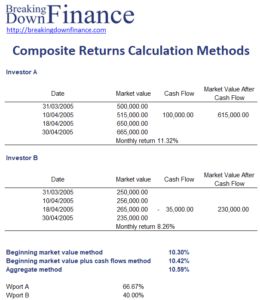

The return of a composite is a weighted average monthly return of the accounts in the composite. The three methods differ slightly in how they weigh the monthly returns. Weights can be based on:

- the beginning of period account value

- the beginning of period account value plus the weighted average external cash flows (ECFs) for the period.

Note that end of period account values cannot be used, as that would increase the relative weighting of the accounts with the higher relative return for the period.

There is also a third method. In this case, the firm should aggregate the accounts’ beginning value and ending market values to obtain total beginning and total ending composite values. Additionally, all the external cash flows should be aggregated as well. Using this data, it is then possible to directly calculate the return of the composite as if it were one big account.

Example

The above description of the different methods may sound somewhat intimidating. Fortunately, all three methods are nothing more than weighted averages that can easily be calculated using a financial calculator or spreadsheet software.

The following table implements all three approaches using a simple numerical example. The spreadsheet used to create the example is available for download at the bottom of the page.

Summary

We discussed three different methods firms can use to report composites’ performance to prospective clients. Firms are required to use one of these methods under GIPS.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Composite returns calculation methods Example