Impact of Inflation on Capital Budgeting

The impact of inflation on capital budgeting should be taken into account in the capital budgeting process. The effect of inflation on capital budgeting is related to the following aspects: the analysis of nominal versus real cash flows, the impact of inflation on project profitability, the impact of inflation on tax savings from depreciation, the impact of inflation on the value of payments to bondholders, and the differential impact of inflation on revenues and costs.

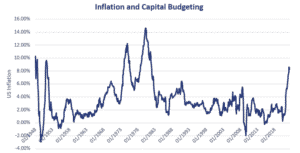

While inflation has been fairly modest in the past, the recent pick-up in inflation has made this aspect increasingly important. On this page, we discuss each of these aspects in more detail.

Inflation effects on capital budgeting

Inflation is a complication that must be considered as part of any capital budgeting process:

- Analyzing nominal or real flows. Nominal cash flows reflect the impact of inflation, while real cash flows are adjusted downwards to remove the effects of inflation. Although either nominal or real cash flow can be used in the capital budgeting process, it is important to match the type of cash flows with the discount rate. Nominal cash flows should be discounted at the nominal discount rate while real cash flows should obviously be discounted at a real discount rate.

- Changes in inflation affect project profitability. If inflation is higher than expected, future project cash flows are worth less, and the value of the project will be lower than expected. The opposite is also true, however. If inflation turns out to be lower than originally expected, future cash flows from the project will be worth more, effectively increasing the project’s value.

- Inflation reduces the tax savings from depreciation. If inflation is higher than expected, the firm’s real taxes paid to the government are effectively increased because the depreciation tax shelter is less valuable. This is because the depreciation charge, which is based upon the asset’s purchase price, is less than it would be if recalculated at current (i.e. inflated prices).

- Inflation decreases the value of payments to bondholders. Bondholders receive fixed payments that are effectively worth less as inflation increases. This means that higher than expected inflation shifts wealth to issuing firms at bondholders’ expense.

- Inflation may affect revenues and costs differently. If prices of goods change at a different rate than the prices for inputs used to create those goods, the firm’s after-tax cash flows may be better or worse than expected.

The difficulty with incorporating inflation is the fact that future inflation needs to be forecasted, which is notoriously difficult. It is best to rely on central bank forecasts.

Summary

We discussed the effect of inflation on capital budgeting decisions. If inflation is higher or lower than expected, this may have a material impact on the profitability of a project. With inflation picking up in recent years, assumptions on future inflation have become more important.