Net Payment Cost Index

The net payment cost index is an approach that can be used to compare the cost of different life insurance policies. Because life insurance is a kind of permanent insurance, the number of variables involved can make any such comparison quite complex. It is very unlikely that any two policies will be the same. The net payment cost index goes some way in allowing clients to compare different life insurances.

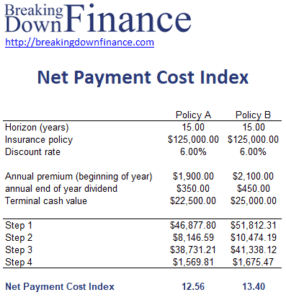

On this page, we discuss the net payment cost index method and the formulas needed to calculate the cost index. We also implement a simple numerical example using an Excel spreadsheet to illustrate the approach. Note that this approach requires an assumed age of death for the insured as well as a discount rate.

The net cost index approach is strongly related to the net surrender cost index approach, which additionally requires a cash value projection at the end of the contract.

Net payment cost index definition

The net cost index assumes the individual dies at the end of the horizon and the terminal cash value is not considered. The approach is typically used if the insurance is projected to be paid up to that point.

The steps are the following:

- compute the future value of the premiums paid, an annuity due (dividends at the start of the year)

- compute the future value of the dividends, an ordinary annuity (dividends at the end of the year)

- compute the future value cost of insurance, i.e. step 1 – step 2

- annuitize this future value difference for the annual cost (annuity due because premiums are paid at the start of the year)

- Divide the results by $1000 of insurance policy amount to index the annual cost

Cost index example

While the above steps may sound somewhat abstract, things will be much clearer once we consider an example. The following spreadsheet applies the above steps to calculate the net cost index and net surrender cost index.

The spreadsheet used to create this table can be downloaded at the bottom of the page.

Summary

We discussed one approach to compare the cost between insurance policies. Another approach is the net surrender cost index approach.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Net Payment Cost Example