Residual dividend model

A residual dividend model or residual dividend policy is a method that companies use to determine the dividends they will pay out to shareholders. While there are a number of ways in which a company can pay out dividends (stable dividends, constant dividends, or residual dividends), most companies use a residual dividend policy. In the case of a residual dividend approach, the company will base dividends on earnings less funds that the companies expects to need to finance projects.

On this page, we discuss the passive residual dividend policy formula, discuss a residual dividend policy example. We use an Excel spreadsheet to create a residual dividend policy calculator.

Residual dividend model formula

There is no single formula in the case of the residual dividend policy. Instead, we need to follow a number of steps.

- Identify the optimal capital budget

- Determine the amount of equity needed

- Meet the equity requirements to the maximum extent possible with retained earnings

- Pay dividends with the residual earnings or leftover earnings

Thus, the company needs to determine its investment opportunity set, the target capital structure, and the cost and access to external capital.

Residual dividend model advantages and disadvantages

There are at least two advantages. First, the model is easy to use. Second, the model allows management to pursue investment projects without being constrained by dividend considerations.

There are disadvantages to the approach as well. In particular, the dividend payments may be volatility if they or only based on a single year at a time. That’s why many companies base the residual dividend based on a multiyear period. That way, leftover earnings can be paid out over multiple years. This is called a long-term residual dividend model.

Residual dividend model example

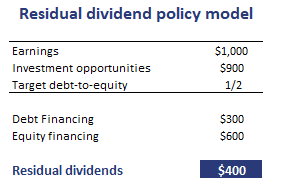

Let’s consider a residual dividend policy example. The following table illustrates how a company can determine the residual dividend after determining the amount of earnings that need to be retained to maintain a certain capital structure.

The Excel file can be downloaded below.

Summary

We discussed the residual dividend policy method. This approach is commonly used by companies to set the dividend in such a way that it does not hamper a company’s ability to pursue investment opportunities.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Residual dividend policy model