Dollar cost averaging (DCA)

Dollar-cost averaging (DCA) is an investment approach that is often advised in situations where investors wish to build up a portfolio over time. The approach aims to help investors to avoid ‘buying high’ or to have to time the market.

Dollar cost averaging is not related to the USD currency. As such, the approach is also referred to as pound cost averaging, rupee cost averaging, euro cost averaging, etc depending on the investor’s domestic currency. Still, all these terms refer to the same investment approach. They are all variations to something which we could refer to more generally as money cost averaging.

While a dollar cost average approach definitely has its merits – it’s definitely safer than investing all your money at once, at one particular price – investors might also want to consider a slightly more sophisticated approach called value averaging.

Dollar cost averaging definition

What is dollar cost averaging? Basically, instead of investing a lump sum in the stock market, dollar cost averaging argues that we should instead spread the investment over several periods. For example, rather than investing $10,000 all at once, we invest $2,500 every quarter, spread out over one year. This way, we will (per definition) have paid an average ‘dollar cost’ per share that is lower than the highest share price experienced over that period.

In particular, had we randomly invested all money at one particular point in time, then that moment might have coincided with a peak in the price of the security we wanted to invest in. As such, dollar cost averaging prevents us from investing all our money at a price peak.

When we dollar cost average, we therefore avoid investment ‘timing’ from adversely affecting our performance. As we explain in the part on dollar-weighted returns, the particular point in time when we add or withdraw money from a portfolio can have a significant impact on our performance.

Dollar cost averaging formula

There’s no dollar cost averaging formula that is needed to perform the approach. Instead, we need choose the size and the frequency of the periodic investment.

In doing this, we should take into account transaction costs. Generally speaking, the higher the transaction costs, the lower the frequency and the higher the size of the periodic investment should be.

Dollar cost averaging example

As the above definition of dollar cost averaging might still be somewhat vague, we will now illustrate a dollar cost averaging strategy using a simple numerical example. To illustrate the concept of dollar-cost averaging, we use DCA investing to invest money in an Exchange Traded Fund (ETF). While the example below buys shares in an ETF, DCA investing can also be used to invest in individual stocks or mutual funds.

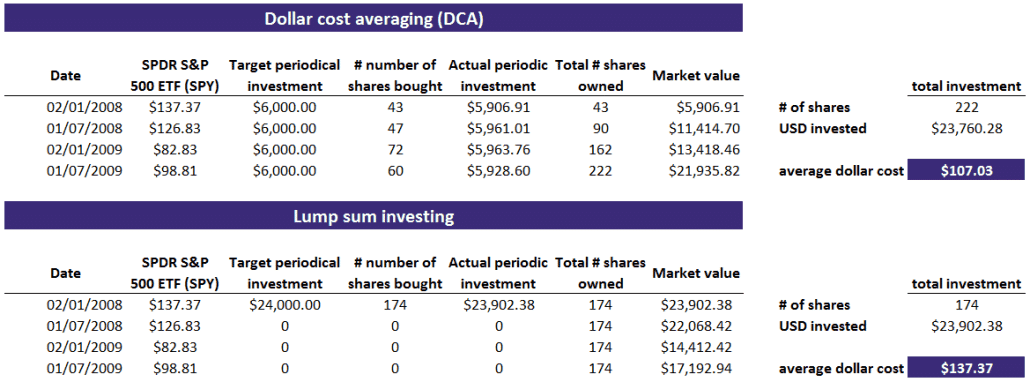

Let’s consider an investor that wishes to invest approximately $24,000 in SPY, a ETF tracking the S&P 500. He or she can opt to invest all the money at once (invest lump sum) or to dollar cost average. In the case of a dollar cost average strategy, we invest 1/4th (i.e. $6,000 every quarter). Lump sum investing on the other hand, consists of investing the $24,000 at once.

The results in the table are clear. By not having spread the purchase of SPY shares, we bought at the very top. The DCA approach however, fared better. When we calculate the average cost per share or ‘average dollar cost’, this becomes even more obvious. The DCA approach allowed us to buy more SPY shares, at a price per share approximately 25% lower.

What is important to note is that dollar cost averaging works best in periods when markets fluctuate or decline. In those two cases, investing all the money at once will obviously lead to lower returns. However, in the case of a rising market, lump sum investing will yield a higher return. However, it is almost impossible to determine in advance how financial markets will perform in the future. In that sense, dollar cost averaging is a conservative approach to investing money in the stock market.

dollar cost averaging myth

While the above example clearly illustrates the benefits of dollar cost averaging, the method has been subject to criticism as well. In particular, over longer investment periods, the benefits of dollar cost averaging are fairly small. While this might be true, the approach is useful in that it helps investors to invest when markets are declining. While people might be reluctant to invest in such situations, the above mechanical approach can be helpful to overcome emotions.

Finally, as we already mentioned above, research has shown hat investors are better off relying on the value averaging approach we already briefly mentioned in the introduction.

Summary

We illustrated how to dollar cost average when investing money. The approach helps investors to avoid market tops and take advantage of declining markets.

Dollar cost averaging calculator

Want to perform a DCA approach? Download the Excel spreadsheet here: dollar cost averaging.