Active share

Active share is a measure used by fund managers that are benchmark-aware, meaning that they try to be active and ensure that they deviate sufficiently from the benchmark. Active share and active risk are two measures used to determine the acceptable level of deviation from the benchmark.

On this page, we discuss the active share formula, illustrate the approach using an example and finally provide an Excel spreadsheet that implements the approach. The spreadsheet can be downloaded at the bottom of the page.

Active share formula

Active share (AS) measures the degree to which the number and sizing of the positions in a manager’s portfolio are different from those of a benchmark. It is given by the following equation:

where n is the total number of securities in the benchmark or the portfolio,

Active share example

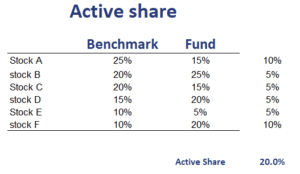

Next, let’s consider an example of how to calculate AS. The following table presents a case where the AS is calculated for a portfolio consisting of 6 securities.

To do the necessary calculations, we need to have the weights of the securities in the benchmark and the weights of the securities in the portfolios. We can then calculate the absolute value of the deviations, sum everything and divide by 2. This yields an AS of 20%. The spreadsheet is available for download at the bottom of the page.

Summary

We discussed active share (AS), an important measure used to determine whether or not a mutual fund manager is actively managing a portfolio. The higher the AS, the more the portfolio deviates from the benchmark and thus the more active the fund manager. It is important to keep in mind that that AS should always be considered together with the tracking error or active risk. That’s because it is possible to construct portfolios with a high AS and a lot tracking error (by using securities that are not in the benchmark).

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Active Share calculator