Return Stacking

Return stacking is a fairly new investment approach that is slowly becoming more popular. Return stacking refers to applying a modest amount of leverage to a diversified investment portfolio that holds different asset classes. The aim is to increase expected returns while simultaneously maintaining or even lower the riskiness of the portfolio.

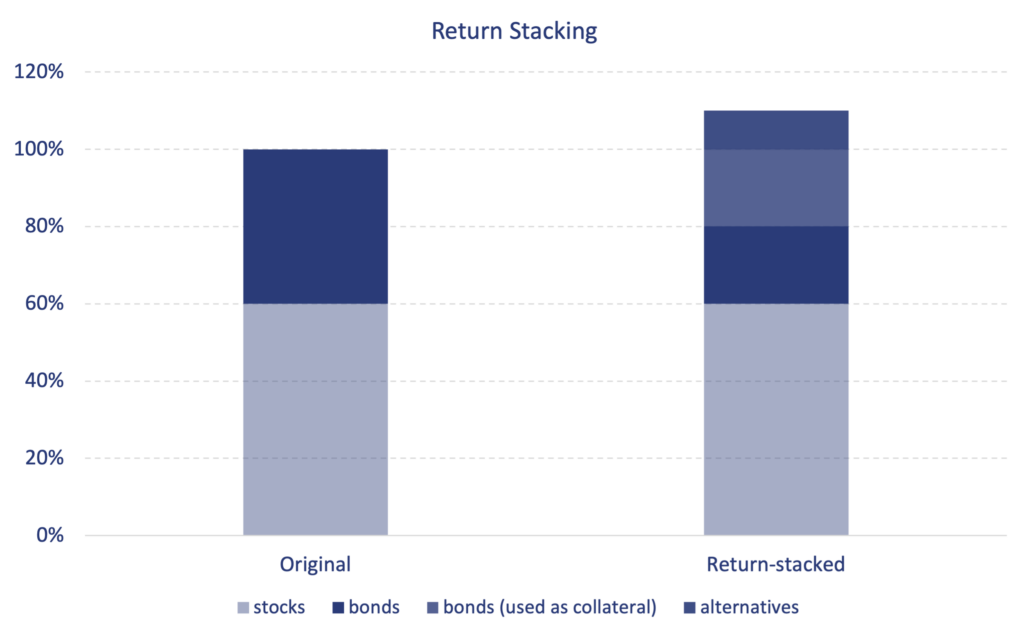

Essentially, the approach consists of layering one investment return on top of another, effectively achieving more than $1.00 of exposure for each $1.00 invested. By doing this with uncorrelated assets, return stacking can reduce the riskiness of the overall portfolio. It is important to keep in mind that the goal is to maintain a core stock and portfolio while introducing new, lowly correlated return streams.

On this page we discuss how return stacking is performed, how it works best and how investors can easily get exposure to a return-stacked portfolio simply by buying an ETF.

How does Return Stacking work?

Return stacking is a two-step process. In particular, we need to borrow and then we stack returns. Let’s consider a simple example. Imagine you have a diversified portfolio that includes stocks, bonds, and other assets. The approach involves freeing up capital and then “stacking” different sources of expected return atop one another. The goal is to enhance the efficiency of invested capital by combining returns from various assets.

One example of stacking returns is to use a part of the bond portfolio as collateral to invest with modest leverage in another asset class. By adding an asset class (e.g. gaining exposure through futures) to the portfolio, the overall riskiness of the portfolio can go down. By using the bonds as collateral, the original asset allocation does not change.

The following bar chart illustrates the process:

What are the advantages of Return Stacking?

Diversification and Risk Reduction: Return stacking works best when the assets are lowly or negatively correlated. This diversification helps spread risk across different investments. For instance, if one asset class experiences a downturn, another might perform well, offsetting the losses. In practice, it is very hard to find asset classes that are lowly correlated, particularly in periods of market stress since correlations tend to go up.

There is, however, one important potential disadvantage to a stacking approach. We need to keep in mind that since we borrow money there is also a cost involved. So it could be that the stacked return is negative. The investor will have to pay interest on the borrowed money regardless.

Are Return Stacking products available?

One of the pioneer investable products that allows investors to get exposure to the approach in a managed way is the NTSX ETF from WisdomTree. NTSX combines 90% U.S. large-cap stocks with 60% exposure to intermediate U.S. treasury bonds via futures contracts. The track-record of these products is typically still too short to draw meaningful conclusions.

Summary

In summary, return stacking aims to help investors unlock the benefits of diversification by using their capital more efficiently and effectively. By layering returns from different asset classes, we can potentially achieve higher risk-adjusted returns.