Betting Against Beta (BAB)

Betting against beta is a type of low risk investing. The approach is suggested by Andrea Frazzini and Lasse H. Pedersen. On this page, we discuss how to construct a betting against beta portfolio. Next, we provide some potential explanations why a betting against beta approach works in practice.

How does betting against beta work?

To understand the intuition of why betting against beta works, we first have to consider the Capital Asset Pricing Model (CAPM).

This models says that a security’s expected returns should be proportional to its beta. For example, if security 1 as a beta of 0.7 and security 2 has a beta of 1.4, then this means that the expected return of security 2 should be twice as high, on average. Interestingly, however, the CAPM does not always hold in practice.

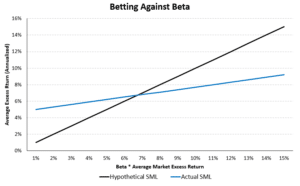

In particular, the so-called ‘securities market line’ (SML) is flatter than expected. As a consequence, securities with a low beta actually have higher excess returns than predicted by their beta. Conversely, high-beta stocks tend to have excess returns that are too low, compared to their high betas.

How to exploit this mispricing?

This is clearly a case where the data does not fit the theory, but how can we exploit this mispricing? The low-beta stocks earn higher excess returns than predicted and the high-beta stocks earn lower excess returns than expected. So it is probably a good idea to buy the safe stocks and short-sell the risky stocks. This strategy, however, is not without risk. First of all, there is still market risk if we are not careful. To see this, consider again security 1 and security 2. Suppose we buy $1 of security 1 and sell $1 of security 2. In that case, our portfolio beta will be 0.7 – 1.4 = -0.7. Hence, we have a negative market beta.

To solve this, we should actually buy $1.4 of security 1 and short-sell only $0.7 of security 2. This will be a market neutral portfolio that is expected to generate alpha. In practice, this means that we leverage the safe stocks, and go short the risky stocks.

What drives the low-risk mispricing?

There are several hypotheses of what may explain the high excess returns of safe stocks and low excess returns of risky stocks. First, some investors are leverage constraint. This means that they are unable or unwilling to take leverage. Therefore, instead of using leverage to genereate high returns, they buy more volatile risky stocks. This buying by leverage-averse and leverage-constrained investors pushes up the price of the risky stocks, lowering their future returns. At the same time, since investors choose risky stocks, they don’t consider safe stocks. This causes these safe stocks’ prices to drop, thereby increasing future returns.

In the above discussion, we focussed on low-beta stocks, i.e. low market risk. Other types of low risk investing also exist, e.g. focusing on low total volatility or low idiosyncratic volatility.

Summary

We discussed the betting against beta strategy. It is possible to calculate stocks’ beta using simple spreadsheet software (Excel) to determine their market beta. Applying the approach in practice is therefore possible.