Market impact cost

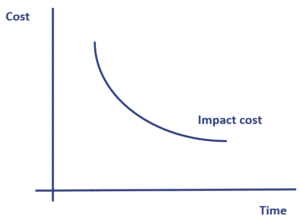

The market impact cost of an investment strategy is an implicit cost related to the price movement caused by managers executing trades in the market. A manager buying securities will tend to bid the price up, whereas a fund manager selling securities will tend to push the price down. On this page, we discuss the factors that influence market impact. We also discuss the market impact of a single trade, called slippage.

Market impact cost determinants

Let’s have a look at the most important components influencing market impact:

- Assets under management (AUM) and the market capitalization of securities. Generally speaking, the lower the absolute level of trading volume, the lower the liquidity and the higher the market impact cost. The larger the fund, the larger the required position and thus the more impact the fund manager will have on the price

- Higher portfolio turnover and shorter investment horizons will generally lead to higher market impact costs

- managers whose trades include information will likely have higher market impact costs

Slippage definition

The market impact of a single trade is often measured by slippage. This is defined as the difference between the execution price and the midpoint of the quoted market bid/ask spread at the time the trade was first entered. The characteristics of slippage are the following:

- slippage costs are usually higher than explicit costs

- slippage costs are greater for smaller-cap securities

- slippage costs are not necessarily greater in emerging markets

- slippage costs are substantially higher in times of high market volatility

Summary

We discussed market impact cost. Market impact costs can have a big influence on managers’ performance because these costs reduce net performance. Thus, it is very important for fund managers to have a good understanding of the impact of their own trading on prices.