Peso problem

The peso problem refers to a problem in finance and economics that occurs when an unprecedented (but not impossible) event may have a very big impact on the performance of the portfolio. In particular, it could be that the event wipes out the entire portfolio of the investor. The problem is very important in the case of back-testing.

Peso problem definition

The Peso problem in finance is the problem that an infrequent event has not yet been observed in the data. Since it is not observed, it will not show up in any of the results of investors’ research.

The origin of the name is unknown, although it is often attributed to the economist Milton Friedman. That’s because the Peso problem may refer to the strong crash in the Mexican peso in the 1970s, when it was allowed to float following almost 20 years of being pegged to the US dollar. During the 20 years leading up to the crash, the volatility of the Mexican peso was really limited. Milton Friedman pointed out that the Mexican peso would probably depreciate a lot if it were allowed to float. And indeed, when it was allowed to float, its value dropped by 46%. That caught a lot of investors by surprise, who were trying to take benefit of the interest rate differential between US deposits and interest rates in Mexico.

Peso problem in finance

In finance, the problem is often discussed in the context of back-testing. Back-testing refers to the research that investors perform the analyze the profitability of certain trading strategies. Clearly, the peso problem is relevant in such cases. If the data the trader uses to determine profitable trading strategies does not include infrequent market moves, he or she may lose a lot of money.

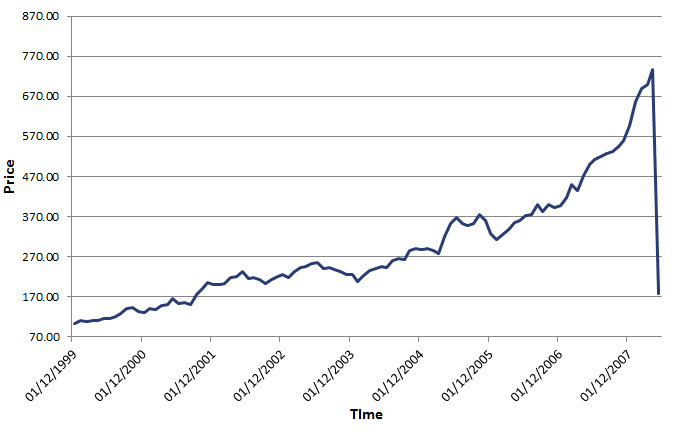

To visualize the peso problem, consider the following chart. Suppose the security has been going up steadily the last couple of years. A lot of investors, looking at the history of the security, may decide that it’s a good investment. However, when a strategy generates attractive returns with very low volatility, investors should be wary. From the figure, we can clearly see a large, but infrequent crash. If such a crash happens only once in a lifetime, chances are high a lot of investors observe it for the first time.

Peso problem solutions

A clear solution to the peso problem does not exist. Instead, investors should be cautious when they find a security that goes up a lot, at very low volatility. There’s a high likelihood that something is wrong. Another way to protect yourself against the peso problem, is by having sound risk management in place. Being conservative and avoiding high leverage can mitigate the effects of a sudden crash.

Summary

The peso problem is an example of a type of risk that is very hard to estimate because it only occurs very infrequently. Investors should avoid assets that have too attractive returns because a crash may be around the corner.