Tail risk

Definition tail risk

What is tail risk? Tail risk is the risk that a tail event takes place. A tail event is an event with a very low possibility of occurring, but that has very large implications for the economy and financial markets. It is an event in financial markets that causes a lot of volatility because market participants did not foresee the event. This type of risk is very difficult to quantify, because tail events only rarely occur. One measure that is used to calculate the impact of tail risk is the expected tail loss. This is the average loss occurring to a portfolio during a tail event. Estimating this expected loss is very difficult, since we typically don’t have a lot of data to estimate the tail loss.

Tail events cause the correlations between securities to go up. As a consequence, diversification benefits decrease a lot and all the assets in the securities in the portfolio incur losses at the same time. This can lead to very deep drawdowns.

There is different way to thinking about tail risk. One reason why most strategies suffer during stock market corrections is because most investors are short volatility. This means that their portfolios suffer when volatility goes up. Tail risk protection therefore consists of strategies that are similar to being long volatility. This means that they benefit when stock market volatility goes up.

Measuring tail risk

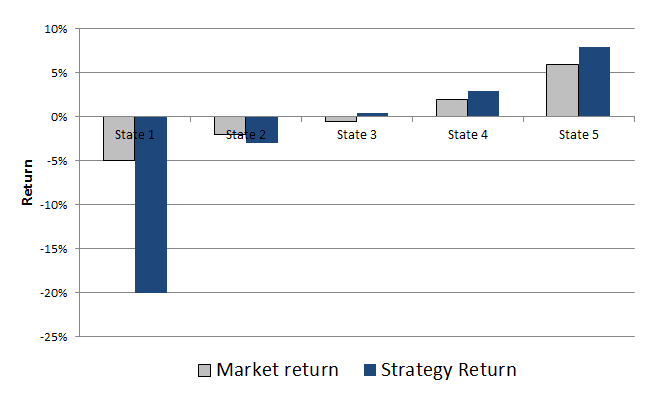

Tail risk is very hard to measure. Tail events only incur very infrequently and their impact may be very different every time they take place. One way of visualizing a portfolio’s exposure to the risk, is using the following approach. First, we take monthly stock market returns, which we divide into different bins. Then we plot the corresponding return of our portfolio. The following figure gives an example:

This way we can see how the portfolio performs during very bad stock market months. Another way to quantify tail risk is by defining the tail value at risk. This measure is very similar to expected shortfall.

Protecting against tail risk

One way of protecting against or hedging tail risk, is by buying downside protection. Downside protection in finance consists of securities that generate positive returns when stock markets go down. One way in which investors can buy such protection is buying buying out-of-the-money put options. These options act as a kind of insurance. When stock markets go down, these put options increase in value. If you buy out-of-the money options, you are effectively long volatility.

Another approach that portfolio managers use, is tail risk parity. It is an asset allocation approach that is extension of risk parity. The approach tries to construct portfolios in such a way that they are robust to strong increases in pairwise correlations. During market crises, drawdowns can be very severe. Allocating some of the capital to a tail risk parity portfolio can help investors in hedging against this risk.

Finally, investors can also consider investing in Managed Futures funds. These funds perform well during crises and provide crisis alpha. This can help boost portfolio performance during periods of financial stress.

Summary

We discussed is the risk of financial ruin following an event that causes the portfolio to drop a lot in value. We discussed ways of measuring this risk (e.g. tail value at risk) and how investors can protect against it. Tail risk funds and tail risk ETFs can also help investors in hedging against this type of risk.