Fixed Income Return Forecasting

To forecast fixed income returns, we need to determine the five components. These are the income yield, the rolldown return, the return due to yield changes, the return loss due to credit losses, and the currency return. On this page, we provide the necessary formulas to perform fixed income return forecasting. An Excel template is available at the bottom of the page.

Modelling fixed income returns

Expected fixed-income returns can be viewed as having 5 components. These five components can be projected to calculate the expected return. These components can also be used after the fact to decompose the sources of return actually earned on fixed income investments.

The five components are the following:

- Income yield. This is simply the annual coupon payment divided by the current bond price. The income yield does not assume a cash-flow reinvestment, although it is possible to assume a reinvestment rate in case the period is longer than one year.

- The second component is the rolldown return. This is a bond pricing model projection of the bond prices in the portfolio assuming the yield curve is unchanged. It can be calculated as follows:

Note that if the yield curve is flat and a bond is initially priced at a premium (discount) to par, the projected price at the end of the period will be lower (higher) than the start-of-period price as the bond’s price is pulled to the par at expiration. With a sloped yield curve that may not always be true in the shorter run (before maturity).

The sum of the income yield and rolldown return is called the rolling yield.

- The third component is the expected price change based on the investor’s expected change in the yield and spread.

Expected price change is calculated based on the expected change in yield and spread using the bond’s duration and convexity:

where MD is the modified duration and C is the convexity of the security.

- Next, we have credit losses. These are calculated based on the estimated probability of default and the expected loss severity

- Expected gains or losses versus investor’s currency. This last component is only relevant if the bond is denominated in a currency that is not the investor’s domestic currency.

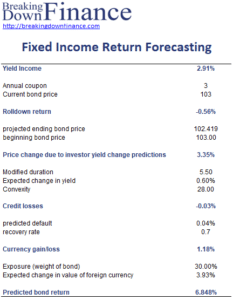

Projecting bond return example

The following example implements the above approach using a numerical example. Note that all the components, except for the yield income, are based on projections.

The spreadsheet used to create the example is available for download at the bottom of the page.

Summary

We discussed how an investor can perform fixed income return forecasting by decomposing fixed income returns into 5 components.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Fixed Income Return Forecasting Example