Short-term Interest Rate Futures (STIR)

Short-term interest rate futures (STIR) are conceptually very similar to forward rate agreements. The futures price of a STIR future is the forward interest rate on deposits starting at the expiry of the future and lasting for 30 days. The standardization of STIR futures means that these contracts are only available on specific maturities. Typically, these maturarities are quarterly. This means that, if the hedge is no longer needed, once will have to close out the futures position.

On this page, we discuss how Eurodollar futures work. These are USD-based STIR futures that are based on deposits of USD 1 million and are priced using the IMM Index convention.

Eurodollar futures

Eurodollar futures are based on deposits of USD 1 million and are priced using the IMM pricing convention. The IMM pricing convention states that the price of the future equals

Because of this particular convention, futures prices will rise when forward rates fall. The forward interest rate itself is calculated from the current spot LIBOR rates in the same way the forward price of an FRA is established. One basis point change in the forward rate will lead to a change in the contract’s value of USD 25

Using this pricing convention, a long Eurodollar futures position will increase in value as forward rates decrease and decrease in value as forward rates increase. This is different from a forward rate agreement, which increases in value as the forward rates increase, and decreases in value as forward rates decrease.

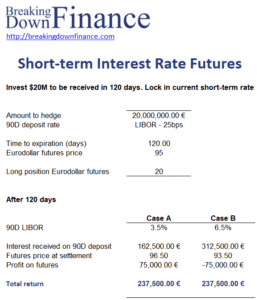

STIR futures example

Let’s consider an example of how a STIR futures can be used to hedge short-term future investing. The spreadsheet used to implement the example is available at the bottom of the page.

Summary

We discussed short-term interest rate (STIR) futures, standardized futures contracts that can be used to hedge short-term future investing. Unlike FRAs, STIR futures are not customized and require margin. The advantage is that STIR futures are not subject to counterparty risk.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Short-term interest rate futures (STIR) example