Comparable Company Analysis

Comparable company analysis uses so-called relative valuation metrics for companies from the same industry to estimate the present value of the equity. It may then add a takeover premium (which is typically estimated separately) to determine a fair price for the acquirer to pay for the target company.

On this page, we discuss the five steps typically involved when applying comparable company analysis. We also include a simple numerical example. The Excel template used is available for download at the bottom of the page.

Comparable company analysis template

Comparable company analysis involves the following five steps:

1. Identify the set of comparable companies: comparables analysis, as the name suggests, involves identifying a set of companies that are similar to the target firm. Ideally, the sample of other companies will come from the exact same industry as the target and have similar size and capital structure.

2. Calculate a number of relative value measures based on the current market prices of companies selected in step 1. Some analysts prefer to use relative value measures based on the enterprise value (EV), which is the market value of the firm’s debt and equity minus the value of cash and investments. These include the EV to free cash flow, EV to EBITDA, and EV to sales. Other relative value metrics that are commonly used use equity multiples such as the price to book (P/B), price to sales (P/S), and price to earnings (P/E). In the case of some industries, very specific multiples may be more appropriate than the ones outlined above..

3. Calculate descriptive statistics using the accounting data collected and apply the measures to the target firm. Analysts will often calculate both the mean, median, as well as a range for the different measures and apply those to the estimates for the target to determine the target’s value. The value of the target is simply the value is equal to the multiple times the appropriate variable: for example, using the P/E ratio:

In theory, different relative value measures should produce similar estimates for the target’s value. This would be the case if all firms are valued fairly. If the estimates differ significantly, the analyst will have to make a judgment.

4. Estimate a takeover premium. The takeover premium is the amount that the takeover price of each of the target’s shares must exceed the market price in order to persuade the target shareholders to approve the merger deal. This premium is usually expressed as a percentage of the target’s stock price and is calculated as:

where TP is the takeover premium, DP is the deal price, and SP is the target company’s stock price. To estimate an appropriate takeover premium, analysts usually look at the premiums paid in recent takeovers of companies most similar to the target firm. Note that takeover premia can be timevaring and depend heavily on the business cycle and investors’ willingness to take risk.

5. calculate the estimated takeover price for the target as the sum of estimated stock value based on comparables and the takeover premium. The estimated takeover price is considered a fair price to pay for control of the target company. Once the takeover price is calculated, the acquirer should compare it to the estimated synergies from the merger to make sure the deal is profitable.

Comparable company analysis example

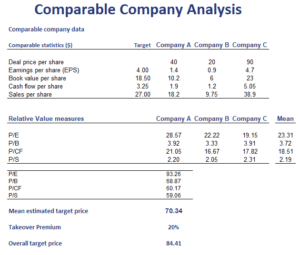

The following table illustrates the necessary calculations using a simple template. The template is available for download at the bottom of the page.

Summary

We discussed how to perform comparables analysis to determine the appropriate price for a target company.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Comparable Company Analysis template