Comparable Transaction Analysis

Comparable transaction analysis is a valuation method used in private equity that uses details from recent takeover transactions of broadly similar companies to estimate the target’s takeover value. The methodology behind this kind of transaction analysis is very similar to the comparable company approach. The only difference is that all of the comparables are companies that have recently been taken over.

By far the main challenge of this approach is finding enough relevant takeover transactions for companies that are sufficiently similar to the target being valued. The advantage of this approach is that, since we are using recent transaction data, it means that the takeover premium is already included in the price. Thus, there is no need here to calculate a takeover premium separately. Comparable transaction analysis involves a number of steps which we discuss in more detail below.

We also discuss a numerical example. A comparable transaction Excel template is available for download at the bottom of the page.

Comparable transaction analysis steps

So what are the relevant steps if we want to estimate the value of a merger target using comparable analysis? We should go through at least the following set of steps:

- Identify a set of recent takeover transactions: Ideally, all of the takeovers will involve firms in the exact same industry as the target and have a similar capital structure. In practice, it can be very hard to find these kinds of deals. Instead, the analyst will likely have to use some judgment as to what recent merger deals are most applicable to the analysis

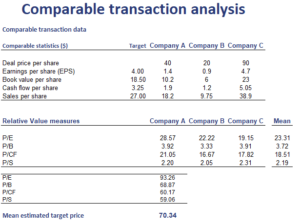

- Calculate various relative value measures based on completed deal prices for companies in the sample. These measures used here are the same as those used in comparable company analysis (.e.g. P/E, P/CF). In this case, however, they are based on prices for completed M&A deals rather than current market prices.

- Calculate descriptive statistics for the relative value metrics and apply those measures to the target firm. Again, analysts will typically calculate the mean, median, and range for the chosen relative value measures and apply those to the firm statistics for the target to determine the target’s value.

Comparable transaction analysis template

Let’s apply the method to a numerical example. The following table illustrates the approach using some sample data:

The spreadsheet is available for download at the bottom of the page.

Summary

We discussed comparable transaction analysis to value a target company in a merger or takeover.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Comparable transactions approach