Intangible Value

Intangible value refers to an improved way of measuring the intrinsic value of a company by taking into account organisational capital. By adjusting the book value of the company for intangibles, value investors can improve their estimate of the fair value of a company. Research has shown that this adjustment of the book value of a company improves the performance of value strategies significantly.

In recent years, Intangible assets have started to play an increasingly important role in the US economy. Academic studies estimate that intangible capital contributes about 50% to overall corporate capital stock creation in developed economies.

There are two kinds of intangibles:

- externally acquired intangibles: these intangibles are the result of acquiring another firm. This refers mainly to goodwill.

- internally generated intangibles: these are the intangibles that a company creates by spending money on human capital, branding, and R&D.

We are interested in the second type of intangibles. These are expenses that are in reality more akin to investments. Companies that make these investments maintain or improve their moat. Such expenses, however, are not capitalized on the balance sheet under today’s conservative accounting standards such as GAAP and IFRS.

At the same time, Intangible assets are valuable because they can provide a competitive advantage for a company, such as through brand recognition or patented technologies. In a way, the approach gives us a tool in measuring the moat of a company.

On this page we discuss the definition of intangible book value, how investors can estimate the stock of intangible capital from Selling, General and Administrative Expenses (SG&A) and how this results in an improved value measure called intangible book-to-price. We also provide an Excel spreadsheet that illustratesb how to estimate intangible value.

Intangible book value definition

There are several ways in which we can define intangible value. Here, we follow a simple perpetual inventory method introduced by Eisfeldt and Papanikolaou in 2013 in a paper titled ‘Organization capital and the cross- section of expected returns’ that was published in the Journal of Finance.

We define intangibles (INT) as:

where INT equals the stock of intangible assets, lambda is the depreciation rate and SG&A is the value reported by the company on an annual basis. Since we don’t have INTt0, we need to initialize it:

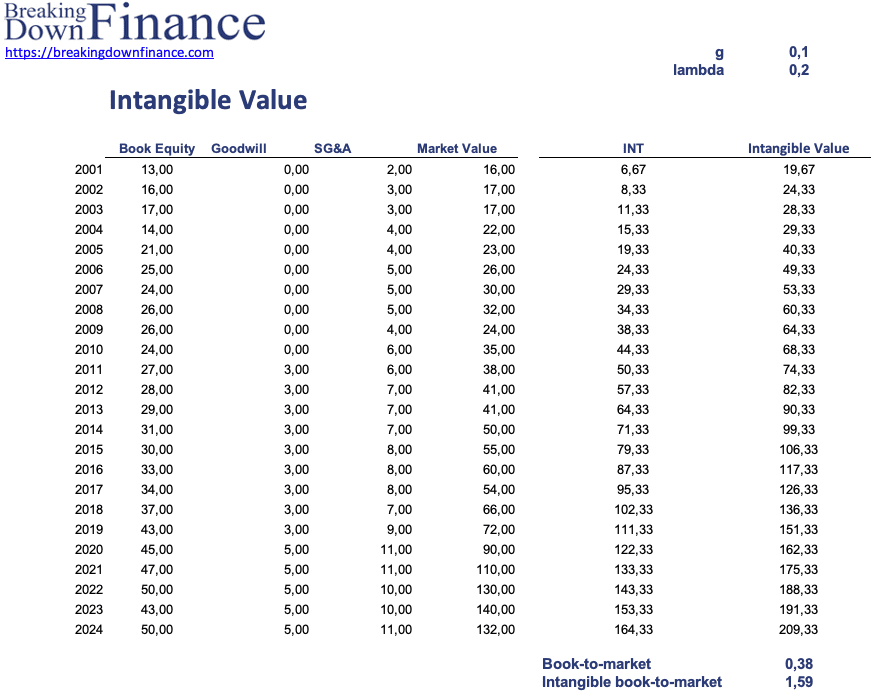

Hence, we use the first observation for SG&A when the firm started reporting to determine INTt0. Next, we set g = 0.1, which is approximately the average growth rate for SG&A. We also assume a depreciation rate of delta = 0.2 which is similar to the values used by Eisfeldt and Papanikolaou.

Intangible book value example

Let’s illustrate the approach using a numerical example. The following table shows how we can collect annual data on SG&A to estimate intangibles.

Once we have the value for intangibles, we can update the book value as follows:

where B is the book value of the company and GDWL is goodwill. We remove goodwill to filter out the effect of M&A activity.

Summary

By considering intangible value when evaluating a stock, value investors aim to identify stocks that are below intrinsic value using a sharper measure of a firm’s value. Value investors expect that the intrinsic value will materialize through improved financial performance. Intangible assets and the company’s willingness to continue to invest can also serve as the catalyst that unlocks the value in a company.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: intangible value calculation