Net Payout Yield

The net payout yield equals the total return received by an investor over a given year in the form of dividends and share buybacks. The net payout yield captures the cash flow that a company decides to return to shareholders. It is sometimes also referred to as the total payout yield or the total shareholder yield.

A number of academic studies have shown that the total payout yield is more predictive of future returns than the dividend yield alone. This is partly caused by the fact that buybacks have become more popular with time, particularly in the US, at the expense of dividends. In Europe, however, dividends are generally more popular than share buybacks. But this too is changing.

The net payout yield is particularly important for investors that seek steady income from their investments. At the same time, a higher payout yield indicates that the company sees limited growth potential internally.

On this page, we discuss how to calculate the net shareholder yield using a simple numerical example. The spreadsheet used is available for download at the bottom of the page.

Net Payout Yield formula

The total payout yield consists of two components:

- the dividend yield

- the buyback yield

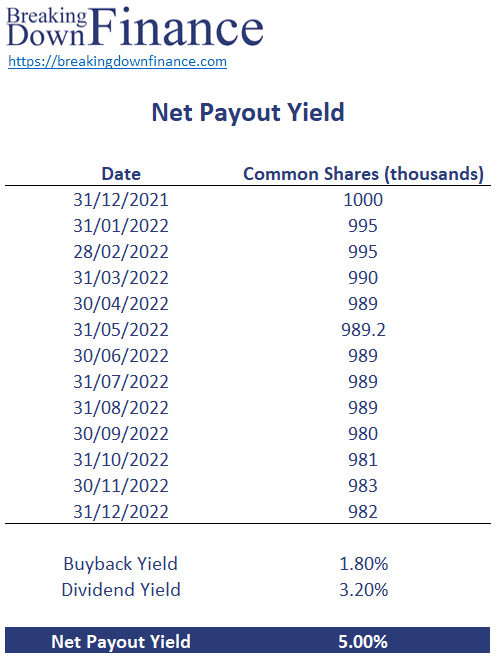

While the dividend yield is typically reported the same is not true for the buyback yield. The buyback yield can easily be calculated by collecting data on the number of shares outstanding. We discuss how to calculate the buyback yield here.

The reason it is important to consider the sum of the buyback yield and the dividend yield is the following. Imagine a very extreme case where a company issues a lot of new stock and simultaneously pays a high dividend yield. In that case, existing investors receive a lot of cash. At the same time, however, their ownership in the company is diluted. Shareholders are entitled to a smaller share of total earnings.

Clearly, it’s important to consider both components to get a full picture of shareholders’ return on investment in the form of cash flows.

The formula for the net payout yield (NPY) is simply:

NPY = Dividend Yield + buyback Yield

Total shareholder yield example

Let’s take a simple example to illustrate the approach. Imagine we have a company that paid 2.3% in dividends over the past 12 months. At the same time, the company bought back 5% of the shares outstanding.

Summary

We discussed the net payout yield or total shareholder yield, a comprehensive measure of the total return that an investor receives in the form of cash that is distributed to shareholders.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Total Shareholder Yield