Gift vs Bequest

An individual with excess capital can gift the capital now or bequest it at death. When choosing between gifting or bequesting, there are a number of practical issues to consider. Gifting now gives up control and cannot be revoked. There are also tax considerations that we need to consider.

This page focuses on these tax considerations. In particular, we evaluate several possible tax situations and formulas that can be used to choose between gifting and bequesting. A spreadsheet that implements the different cases is available at the bottom of the page.

Gift versus bequest formula

To determine what is most favorable, we will calculate the ratio of a gift now versus a bequest at death. A ratio above 1 indicates that from a tax perspective it is favorable to gift now. In each case, the calculations are based on the future value after tax to the receiver.

We consider three scenarios:

- the gift now is tax free to both the receiver and the donor

- the gift now is taxable with the tax paid by the receiver

- the gift now is taxable and the tax will be paid by the donor

Let’s start with the first case, the ratio value of a tax-free gift:

where tig and tie are the tax rate for the giver and receiver, rg and re are the pre-tax return for the giver and receiver, n is the number of years and Te is the estate tax rate.

The second case is a taxable gift, where the gift tax Tg is paid by the receiver:

Finally, the third case is a taxable gift, where the tax is paid by the giver:

The additional term TgTe can be interpreted as a partial gift tax credit against the estate tax bill that reduces the future estate tax.

Charitable gift

A fourth case that we should consider is a charitable gratuitous transfer. In this case, the receiver is a tax exempt charity and the giver receives an immediate tax deduction. In that case, we can use the following formula:

where Toi is the tax rate on ordinary income and rg is the return on the assets in the charity’s portfolio.

Gift versus bequest example

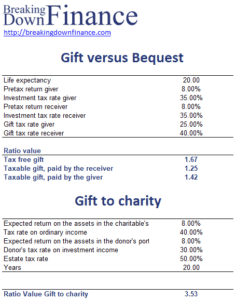

The following table illustrates the necessary calculations using a numerical example. The spreadsheet used to create the example can be downloaded at the bottom of the page.

Summary

We discussed a number of ratios that can be used to evaluate whether or not gifting now or a bequest at death is more attractive from a tax perspective.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Gift vs Bequest Example