Tax preference theory dividend policy

The tax preference theory dividend policy or tax aversion theory states that investors take into consideration taxes when they consider investing in a security. The reason why taxes are important is because dividends have historically been taxed at a higher rate than capital gains. In particular, whereas long-term capital gains are typically taxed at a tax rate of 20%, dividends are often taxed as ordinary income.

The tax preference theory is one of three dividend theories. The two other theories are the bird-in-hand theory and the dividend irrelevance theory. On this page, we discuss only the tax aversion theory of the dividend policy. More details on the other two theories can be found on the pages on the bird-in-hand theory and the dividend irrelevance theory.

Tax preference theory definition

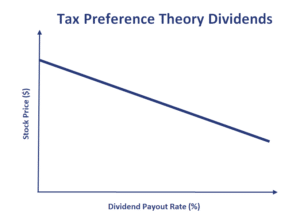

Because the dividend tax rate is typically higher than the capital gains tax rate and most investors are tax averse, investors will prefer NOT to receive dividends because of the higher taxes due on dividends. Taken at the extreme, the tax aversion theory implies that investors want companies to have a zero payout ratio. In that case, investors will not have to pay the higher tax rate on dividends at all.

Then why do companies pay dividends if investors clearly don’t prefer them because of tax aversion? The main reason is that tax laws often prevent companies from accumulating excess earnings indefinitely. To distribute net income to the shareholders, they are therefore forced to make dividend payments.

Summary

We discussed the tax preference theory dividend policy, also known as the tax aversion theory. It is a theory that concludes that companies will try to keep dividends as low as possible if the tax rate on dividends is considerably higher than the tax rate on capital gains.