Momentum Crashes

Momentum crashes are sudden and significant reversals in the performance of high-momentum stocks. Stocks that have exhibited strong price appreciation over the past year experience a sudden and dramatic drop in price. At the same time, the stocks that have sold off over the past year suddenly recover significantly. As a consequence, the cross-sectional momentum strategy exhibits a series of very negative returns.

Momentum crashes were first in a number of papers in the first half of the 2010s. Kent Daniel and Tobias Moskowitz described momentum crashes in a research paper titled “Momentum Crashes” which was published in the Journal of Financial Economics in 2016. Momentum’s tendency to crash was also described by Pedro Barroso and Pedro Santa-Clara in a publication one year earlier, in 2015, in the same journal titled “Momentum Has Its Moments”.

Both papers analyzed stock returns from the worldwide over several decades and identified periods of time when high-momentum stocks experienced sudden and significant reversals. The authors found that these momentum crashes are a distinct and recurring phenomenon in financial markets. Both papers also discuss approaches to manage the risk and improve the returns of momentum strategies.

On this page, we use data to illustrate momentum’s tendency to crash and we discuss a method that can be used to reduce the impact of crashes on momentum returns.

What is a momentum crash?

Let’s take one step back first. A momentum strategy is a strategy that exploits the empirical observation that past returns predict future returns in the cross-section of assets. and is typically implemented by buying past winners and selling past losers. A momentum crash occurs when suddenly the past losers start to violently outperform the past winners.

In fact, it may actually be the case that past winners start to lose and the past losers start to win at the same time. At that moment, both the long end and the short end of the momentum portfolio starts to lose money.

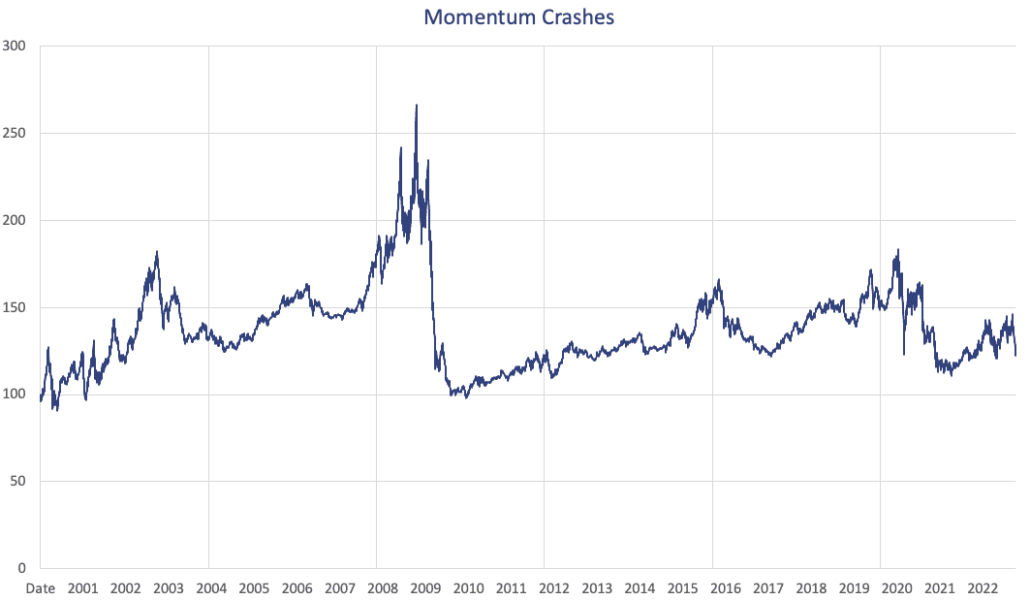

The following figure illustrates the occurrence of a momentum crash during the great financial crisis (GFC). It clearly illustrates that a momentum strategy can suddenly lose considerable amounts of money.

The data used to construct the above figure was downloaded from the website of Kenneth French.

How to avoid momentum crashes?

Is it possible to avoid momentum crashes? Yes. While it is not possible to predict when a momentum crash will occur, it is possible to avoid their adverse impact on performance. In fact, simple risk management can be applied to reduce the drawdown that are typical of momentum strategies. Barroso and Santa-Clara provide such an approach which is called volatility targeting.

In the case of volatility targeting, the strategy reduces its exposure when the volatility of momentum returns starts to pick up. Similarly, when the volatility is low we increase our exposure to the momentum factor.

Summary

We discussed momentum crashes, the tendency for cross-sectional momentum strategies’ to exhibit significant left-tail risk. The impact of such episodes on the returns of a momentum strategy can be addressed by applying volatility targeting.