Takeover Bid Evaluation

In any merger that makes economic sense, the combined firm will be worth more than the sum of the two separate firms. This difference is the gain, which is a function of synergies created by the merger and any cash paid to shareholders as part of the transaction. Takeover bid evaluation is an approach investors and analysts can use to evaluate a bid.

In equation form, we can denote the post-merger value of the combined company as follows:

where:

- VAT is the post-merger value of the combined company (acquirer + target)

- VA is the pre-merger value of the acquirer

- VT is the pre-merger value of the target

- S are the synergies created by the merger

- C is the cash paid to target shareholders

Let’s discuss the gains accrued to the target and the acquirer.

Gains accrued to the target

In most merger transactions, acquirers must pay a takeover premium to entice the target’s shareholders to approve the merger. The target company’s management will try to negotiate the highest possible premium relative to the value of the target company. From the target’s perspective, the takeover premium is the amount of compensation received in excess of the pre-merger value of the target’s shares:

- GainT are the gains accrued to the target shareholders

- TP is the takeover premium

- PT is the price paid for the target

- VT is the pre-merger value of the target

Gains accrued to the acquirer

Acquirers are willing to pay a takeover premium because they expect to generate their own gains from any synergies created by the transaction. The acquirer’s gain is therefore equal to the synergies received less the premium paid to the target’s shareholders:

where Gain A are the gains accrued to the acquirer’s shareholders.

Not that in a cash deal the cash paid to the target shareholders (C) is equal to the price paid for the target (PT).

Cash payment versus stock payment

In addition to the price paid, the ultimate gain to the acquirer or the target is also affected by the choice of payment method. Mergers can either be financed through cash or through an exchange of shares of the combined firm. The chosen payment method typically reflects how confident both parties are about the estimated value of the synergies resulting from the merger. This is because different methods of payment will give the acquirer and the target different risk exposures with respect to misestimating the value of synergies:

- With a cash offer, the target firm’s shareholders will profit by the amount paid over its current share price (the takeover premium). However, this gain is capped at that amount

- With a stock offer, the gain will be determined in part by the value of the combined firm, because the target firm’s shareholders do not receive cash and just walk away, but rather retain ownership in the new firm. Accordingly, for a stock deal we must adjust our formula for the price of the target:

where N is the number of shares the target receives and PAT is the price per share of the combined firm after the merger announcement.

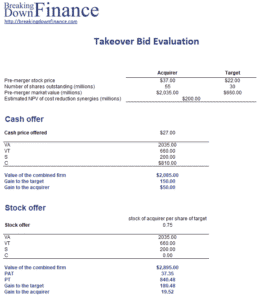

Takeover bid evaluation example

Next, let’s discuss a numerical example of how to evaluate a takeover bid. The following template implements the above approach:

The Excel spreadsheet is available for download at the bottom of the page;

Summary

We discussed how to evaluate a takeover bid from the acquirer’s and target’s perspective.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Takeover bid evaluation tool